Our collection of resources based on what we have learned on the ground

Resources

infographic

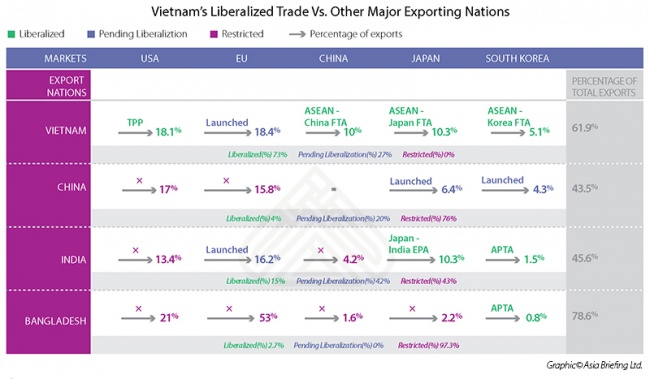

Vietnam's Liberalized Trade Vs. Other Major Exporting Nations

- December 2015

- Members Access

This infographic compares Vietnam's exports with some major global trade partners and the exports of other competing countries.

infographic

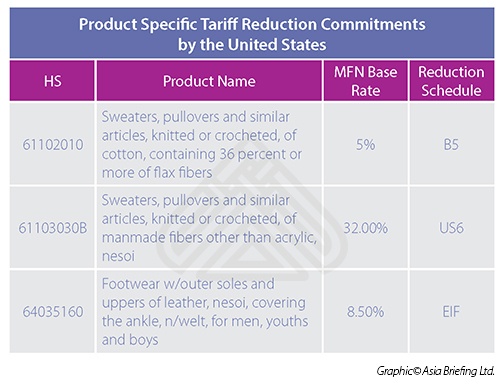

Product Specific Tariff Reduction Commitments by the United States

- December 2015

- Free Access

This infographic lists out the product specific tariff reduction commitments by the United States.

magazine

The Trans-Pacific Partnership and its Impact on Asian Markets

- November 2015

- Members Access

In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

DTA

Convention On Mutual Administrative Assistance In Tax Matters

- May 2015

- Free Access

Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and with a view to promoting economic cooperation between OECD member countries and India.

infographic

Ease of Paying Tax Rankings

- May 2015

- Free Access

Ein Ranking des Schwierigkeitsgrades Steuern zu zahlen "Ease of Paying Tax", der ASEAN Länder sowie Hong Kong, China, Deutschland, den U.S.A., Italien und Indien

DTA

Double Taxation Avoidance Agreement between Indonesia and the U.S.

- April 2015

- Free Access

Double Taxation Avoidance Agreement between Indonesia and the U.S.

FTA

Free Trade Agreement between Singapore and U.S

- April 2015

- Free Access

Establishment of a free trade area and definitions.

FTA

Free Trade Agreement between Singapore and U.S Annex 1A to 3C

- April 2015

- Free Access

National treatment and market access for goods.

FTA

Free Trade Agreement between Singapore and U.S Annex 6A to 20A

- April 2015

- Free Access

Working group on medical products.

DTA

Convention Between The Government Of The Kingdom Of Thailand And The Government ...

- April 2015

- Free Access

Convention between Thailand and the United States of America for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital.

partner-publication

Doing Business in the U.S. Tax Guide

- November 2014

- Members Access

This guide will assist organizations that are considering establishing a business in the U.S., either as a separate entity or as a subsidiary of an existing foreign company. It will also be helpful to anyone who is planning to work or live permanentl...

infographic

Esportazione totale merci ASEAN per destinazione

- July 2014

- Free Access

Questo infographic descrive la percentuale di esportazione del blocco ASEAN, passate e future, verso: Intra- ASIAN, Cina, India, Giappone, UE27, US, Medio Oriente.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us