Our collection of resources based on what we have learned on the ground

Resources

presentation

Indian Income Tax Return Form ITR-5

- April 2017

- Free Access

This form is to be used to file the income tax returns of firms, association of people and body of individuals.

presentation

Indian Income Tax Return Form ITR-6

- April 2017

- Free Access

This form is to be used by companies that do not claim any deductions under Section 11 of the Income Tax Act 1961.

presentation

Indian Income Tax Return Form ITR-7

- April 2017

- Free Access

This form is to be used by people (including companies) that are required to provide income tax returns under specific categories.

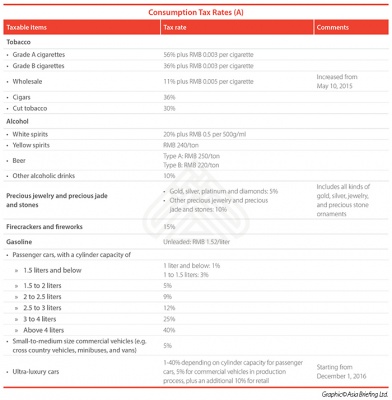

infographic

China's Consumption Tax Rates (A)

- April 2017

- Members Access

This table shows the consumption tax rates for several taxable items.

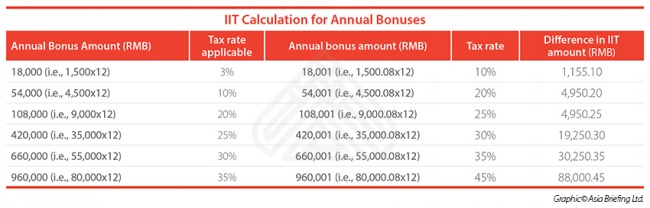

infographic

IIT Calculation for Annual Bonuses

- April 2017

- Members Access

This table shows the optimal compensation package for employees, allowing them to take home the most value within the parameters set by China's tax laws.

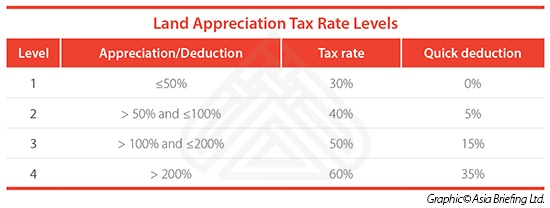

infographic

China's Land Appreciation Tax Rates Levels

- April 2017

- Members Access

This table illustrates the four different levels of China’s land appreciation tax rates.

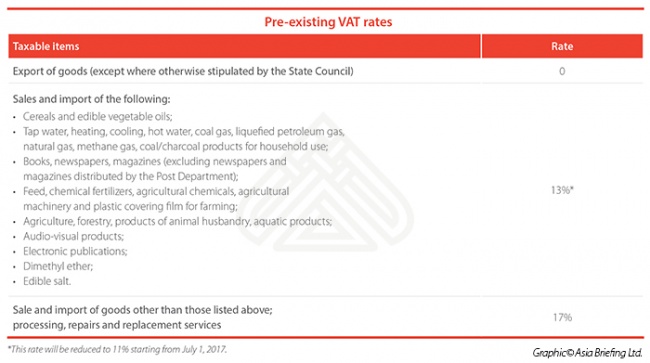

infographic

China's Pre-existing VAT Rates

- April 2017

- Members Access

This table shows China's pre-existing VAT rates.

infographic

China's VAT Rates for Newly Covered Industries

- April 2017

- Members Access

This table shows China's VAT rates for newly covered industries since the VAT reform began.

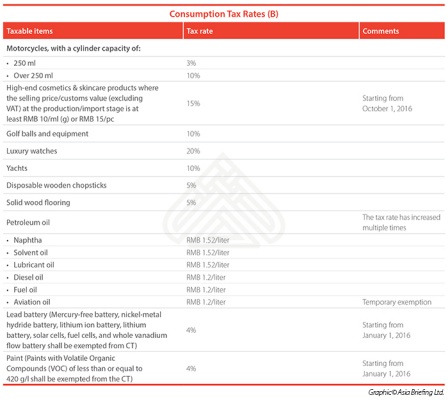

infographic

China's Consumption Tax Rates (B)

- April 2017

- Members Access

This table shows the consumption tax rates for several taxable items.

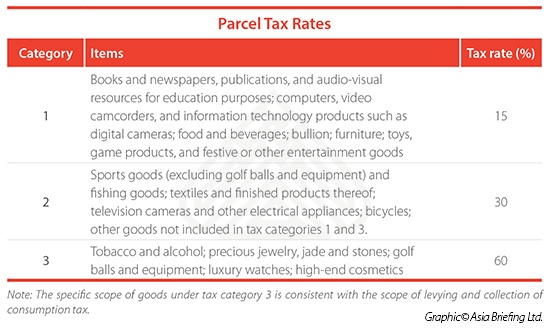

infographic

China's Parcel Tax Rates

- April 2017

- Members Access

This table displays China's parcel tax rates by category.

infographic

China's Resource Tax Rates

- April 2017

- Members Access

The table shows China's resource tax rates by category: metal mine and non-metallic mine.

infographic

China's Stamp Tax Rates for Taxable Documents

- April 2017

- Members Access

This table displays the tax rates related to a series of taxable documents.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us