Our collection of resources based on what we have learned on the ground

Resources

infographic

Corporate Tax Rates in India and China

- March 2013

- Free Access

The graph compares the Corporate Taxes between India and China.

infographic

Chinese Consumption Tax Formula

- March 2013

- Members Access

The formulas show how to calculate Consumption Tax (CT) in China

infographic

Individual Income Tax Liability in China

- January 2013

- Members Access

The table shows the Individual Income Tax (IIT) liability based on period in China and income source

infographic

Comparison of Indian Corporate Income Tax Rates

- January 2013

- Members Access

The table compares the Corporate Income Tax (CIT) rates for domestic and foreign companies in India.

infographic

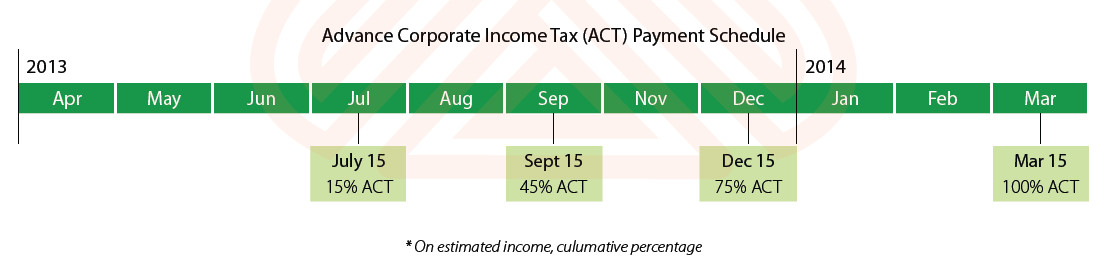

Advance Corporate Income Tax (ACT) Payment Schedule for Indian

- January 2013

- Members Access

The timeline shows the payment schedule of Advance Corporate Income Tax (ACT) for Indian companies.

infographic

Corporate Income Tax in India

- November 2012

- Members Access

The table shows the difference of Corporate Income Tax (CIT) rate between domestic and foreign companies in India.

infographic

Corporate Income Tax and Minimum Alternative Tax by Business Type in India

- November 2012

- Members Access

For different business types in India, the corporate income tax (CIT) and minimum alternate tax (MAT) are different.

infographic

Mandatory Benefit of Social Insurance in China

- October 2012

- Free Access

The diagram shows the mandatory benefit of five social insurances and housing fund, contributed by both the employer and employee.

infographic

Tax Liabilities During Liquidation in China

- June 2012

- Members Access

The table shows the tax liabilities and liability calculations during liquidations of a foreign-invested enterprise in China.

infographic

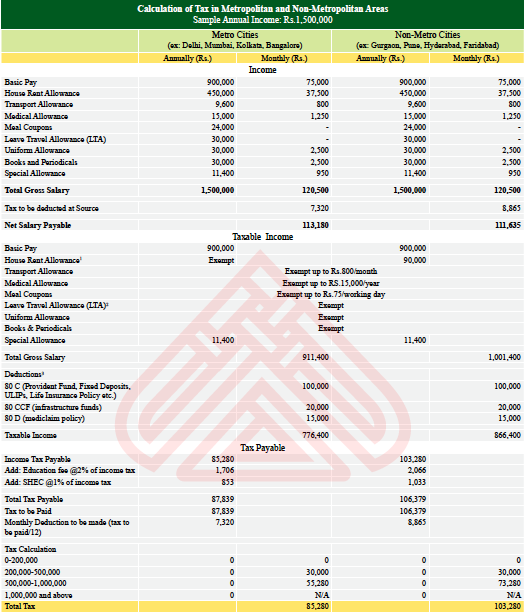

Tax Calculation for Different Areas in India

- June 2012

- Members Access

Calculation of Tax in Metropolitan and Non-Metropolitan Areas in India.

infographic

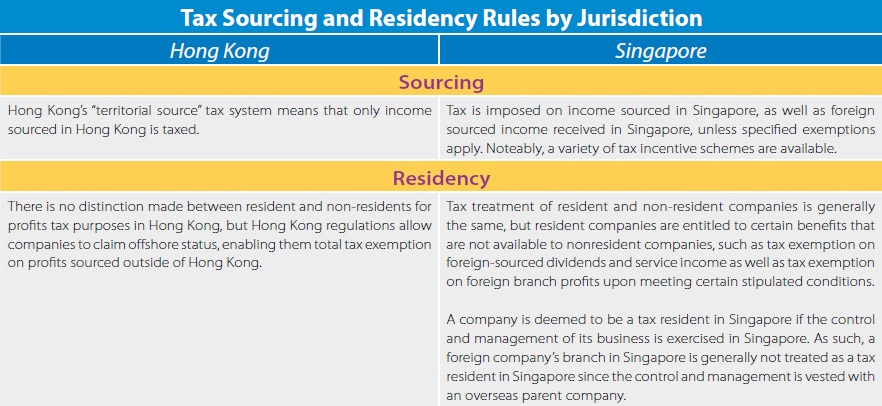

Tax Sourcing and Residency Rules in Hong Kong and Singapore

- May 2012

- Free Access

The table shows the differences of tax sourcing and residency rules by jurisdiction between Hong Kong and Singapore.

infographic

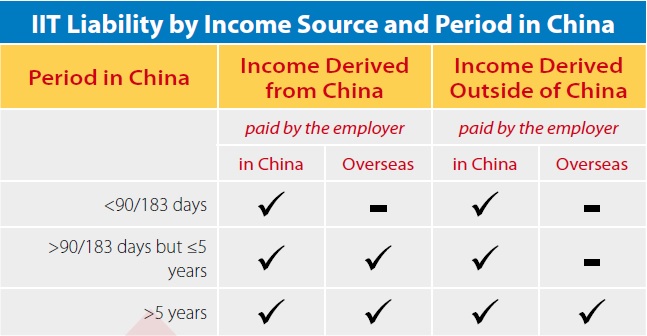

Individual Income Tax (IIT) Liabilities for Senior Personnel in China

- April 2012

- Free Access

The table shows the Individual Income Tax (IIT) liabilities by income source and period in China for senior personnel.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us