Our collection of resources based on what we have learned on the ground

Resources

presentation

Common Labor Issues in China - Risks and Compliance Strategies

- August 2016

- Members Access

In this presentation, our in-house specialist Kyle Freeman introduces you the common labor issues in China, and suggests practices to comply with the current laws as well as to avoid any potential risks.

magazine

Comparador de los tipos impositivos en ASEAN para los años 2016/2017

- August 2016

- Members Access

En esta edición de ASEAN Briefing, examinamos la fiscalidad regional de ASEAN a través de la comparación de impuestos de sociedades, impuestos indirectos y retención de impuestos. Además les presentamos el resumen de los diferentes marcos de cum...

podcast

The Case for Manufacturing in Vietnam

- August 2016

- Free Access

Presented by ASEAN Business Intelligence Associate Dustin Daugherty, this podcast discusses opportunities for FDI in Vietnam’s manufacturing sector and the steps needed to be taken by foreign investors to establish a manufacturing company in the co...

partner-publication

Indonesia Policy Monitor: August 2016

- August 2016

- Members Access

Indonesia presents a host of challenges that can impede the ability of foreign business players from operating at full stride. Among these challenges, the multiple and often overlapping layers of policy making and regulations makes for a complicated ...

partner-publication

Asia Light Manufacturing Outlook: August 2016

- August 2016

- US $40

The August 2016 issue of the Asia Light Manufacturing Outlook report is a 4 page executive-ready assessment and outlook designed to help companies anticipate labor risks and dynamics across key manufacturing countries in Asia. Countries of coverage i...

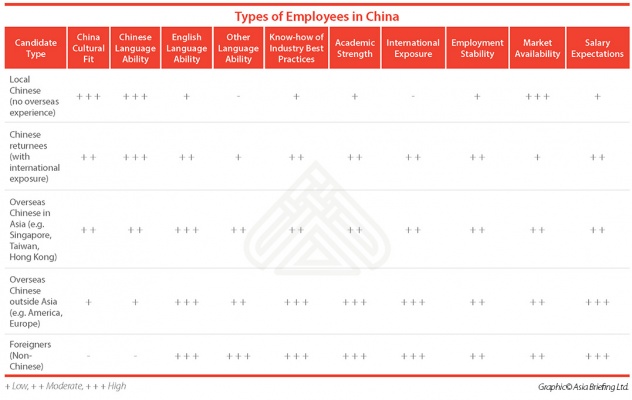

infographic

Types of Employees in China

- August 2016

- Members Access

This infographic compares the different types of employees on various dimensions, from cultural fitness to salary expectation.

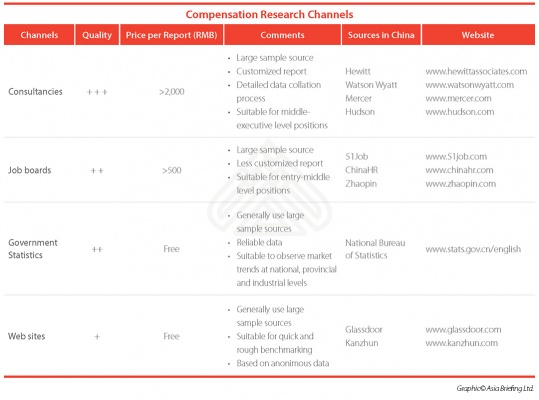

infographic

Compensation Research Channels in China

- August 2016

- Members Access

This infographic compares the different compensation research channel available for Chinese companies and their pros and cons, including the professional HR consultancy companies, popular job boards such as 51Job as well as government statistics.

infographic

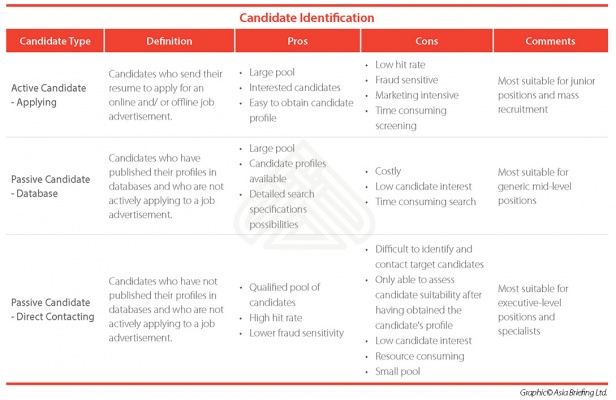

Candidate Identification in China

- August 2016

- Free Access

This infographic compares different types of candidates, the pros and cons they present to the recruiters, and their applicable positions.

infographic

Breakdown of Professional Clusters in China

- August 2016

- Members Access

This infographic gives you some insights about the distribution of talent pool in China.

infographic

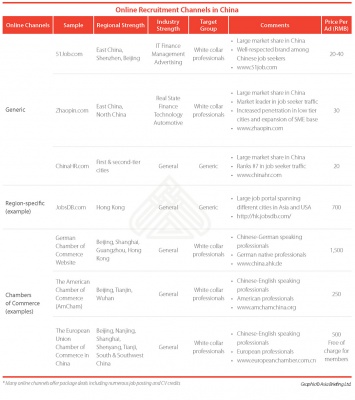

Online Recruitment Channels in China

- August 2016

- Free Access

This infographic compares various recruitment platform companies can choose from in China when searching for potential candidates.

infographic

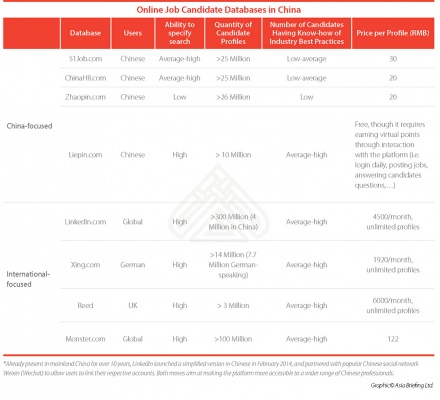

Online Job Candidate Database in China

- August 2016

- Members Access

This infographic compares various online job candidate databases in China, both China-focused and international focused.

infographic

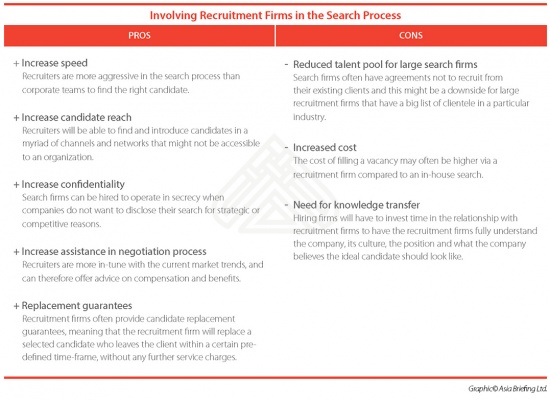

Involving Recruitment Firms in the Search Process

- August 2016

- Free Access

This infographic lists out the pros and cons of oursourcing recruitment to professional recruitment firms for a company.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us