Our collection of resources based on what we have learned on the ground

Resources

infographic

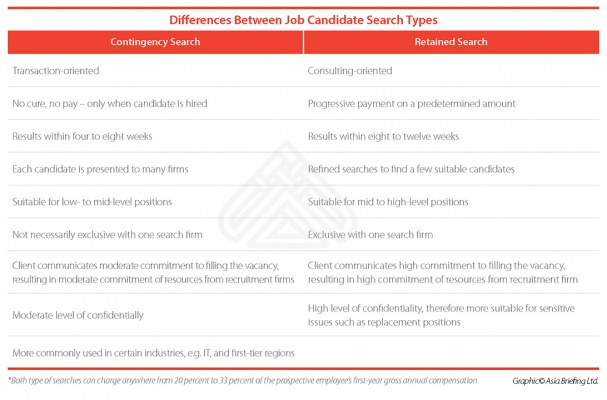

Differences Between Job Candidate Search Types

- August 2016

- Free Access

This infographic shows you the differences between the contingency search and retained search for job candidates.

infographic

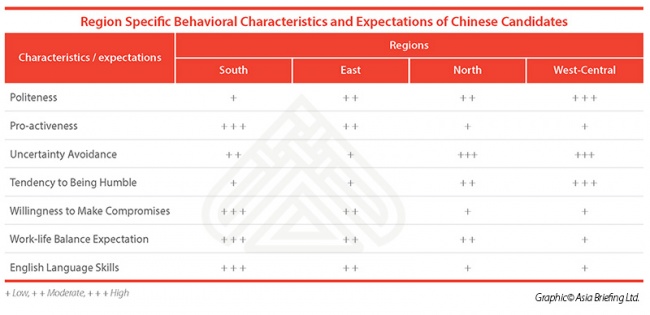

Region Specific Behavioral Characteristics and Expectations of Chinese Candidate...

- August 2016

- Free Access

This infographic gives you some insights what your potential candidates will be like, especailly their politeness, pro-activeness and English language skills etc., based on their regions.

infographic

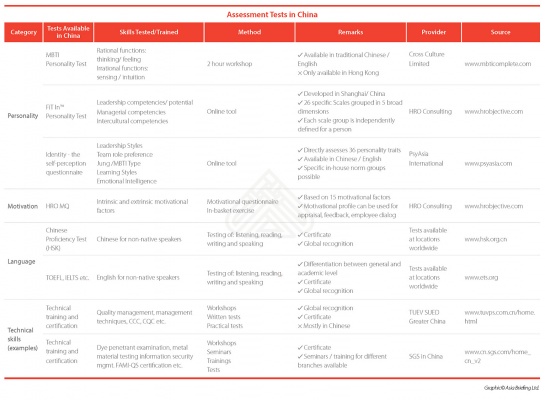

Assessment Tests in China

- August 2016

- Members Access

This infographic lists out the assessment tests available for companies operating in China, including tests in personality, motivation, language and technical skills.

infographic

Differences between Dispatching and Outsourcing in China

- August 2016

- Members Access

This infographic compares dispatching and outsourcing in various dimensions, including the relationship between the employee and the hiring company and the relevant labor laws applicable for the two types of contracts and more.

infographic

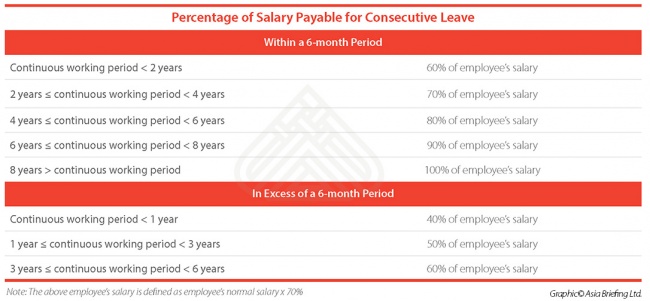

Percentage of Salary Payable for Consecutive Leave in China

- August 2016

- Free Access

This infographic gives you an idea about how much of liability the company should bear for paid consecutive leave based on how long that employee has been working for the company in China.

infographic

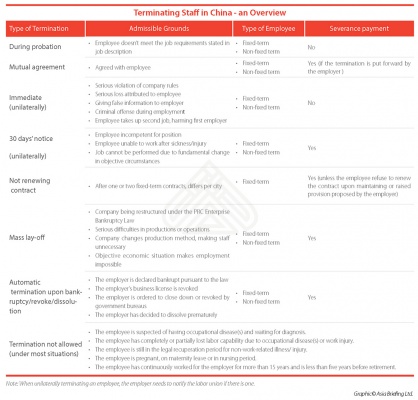

Terminating Staff in China - an Overview

- August 2016

- Members Access

This infographic goes through all the necessary steps when a company decides to terminate the labor contract with its employees.

infographic

China's Visa Categories according to the Major Purpose of Visit

- August 2016

- Free Access

This infographic presents you China’s visa categories according to the major purpose of visit.

infographic

China's Education Industry at a Glance

- August 2016

- Members Access

This infographic presents you the education industry in China from various angles, such as numbers of different types of educational institutions, domestic and foreign investment in the market during the past five years, and more.

infographic

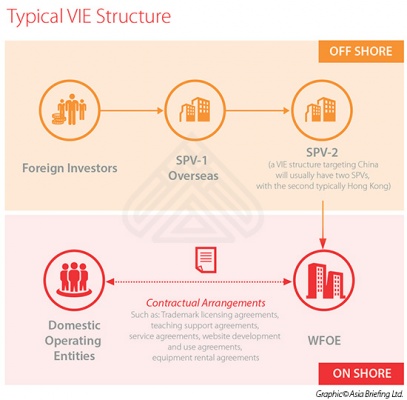

Typical VIE Structure in China

- August 2016

- Free Access

This infographic shows you the typical business model for investing in China's education sector.

infographic

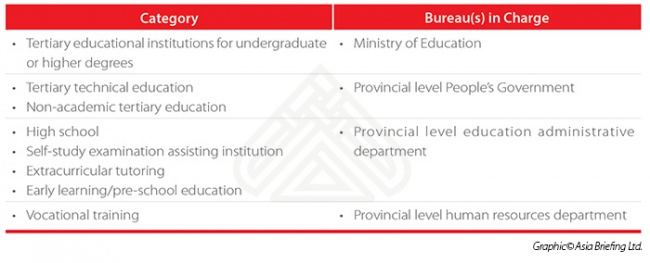

Regulators for Different Types of Educational Institutions in China

- August 2016

- Free Access

This infographic lists out the different bureau in charge for different types of educational institutions in China.

infographic

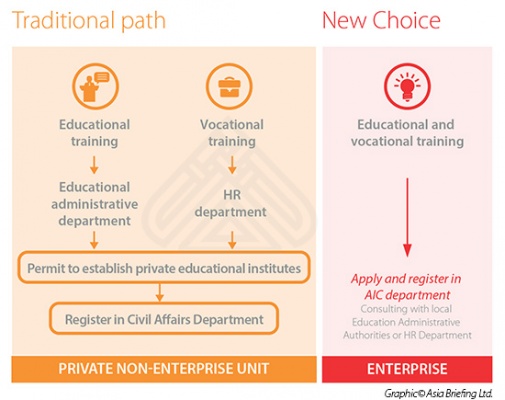

Comparison of the Paths for Foreign Investors to Operate in China's Education Se...

- August 2016

- Free Access

This infographic compares the choice that foreign investors used to have and the new choice they now have to register and operate an educational institution in China.

Q&A

How is the current education market in China?

- August 2016

- Free Access

The education market in China has witnessed tremendous growth in recent years. Already worth RMB 1.6 trillion in 2015, the size of the education market is estimated to nearly double to RMB 3 trillion by 2020, thanks to the rising middle class. Chines...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us