Our collection of resources based on what we have learned on the ground

Resources

Q&A

What’s the difference between Foreign Owned Enterprises (FOEs) and Representat...

- January 2016

- Free Access

The process for PIT is similar between them, but the submission deadlines are different. For ROs, the deadline is based on the calendar year and for FOEs, the deadline is based on the fiscal year.

partner-publication

DPRK Business Monthly: January 2016

- January 2016

- Members Access

This regular publication looks at current international, domestic, and peninsular affairs concerning North Korea while also offering commentary and tourism information on the country.

report

Transfer Pricing in China

- January 2016

- Members Access

When a business transaction occurs between businesses that are controlled by the same entity, the price is not determined by market forces, but by the entity controlling the two businesses. This is called transfer pricing. Such transactions can serve...

magazine

Annual Audit and Compliance in Vietnam 2016

- January 2016

- Members Access

In this issue of Vietnam Briefing, we address pressing changes to audit procedures in 2015, and provide guidance on how to ensure that compliance tasks are completed in an efficient and effective manner. We highlight the continued convergence of VAS ...

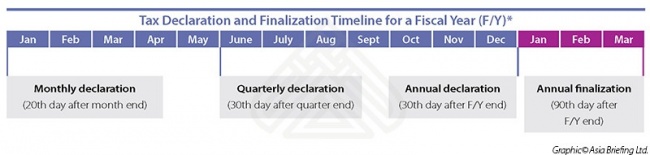

infographic

Tax Declaration and Finalization Timeline in Vietnam for a Fiscal Year (F/Y)

- January 2016

- Free Access

Foreign owned Enterprises in Vietnam must conduct CIT finalization at the end of every year.

infographic

Steps in the Vietnam Auditing Process

- January 2016

- Free Access

Auditing in Vietnam can be divided into 3 main steps

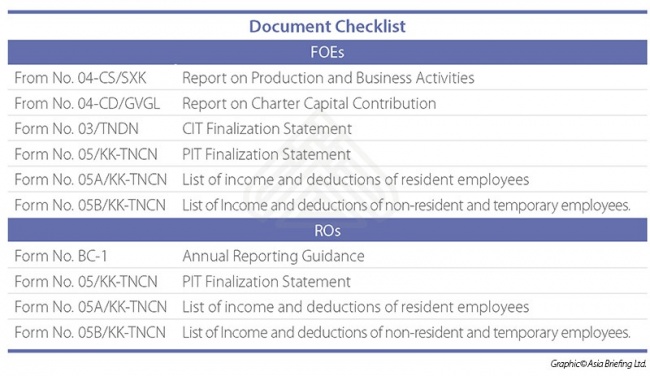

infographic

Document Checklist for Foreign Owned Enterprises and Representative Offices for ...

- January 2016

- Free Access

The requisite documentation needed for FOEs and ROs in the auditing process in Vietnam.

infographic

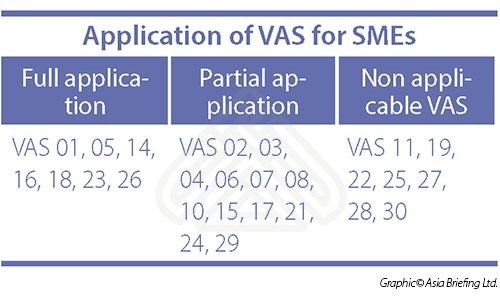

Application of Vietnamese Accounting Standards for Small and Medium Sized Enterp...

- January 2016

- Members Access

Vietnam requires that SMEs comply with a simplified set of accounting standards.

infographic

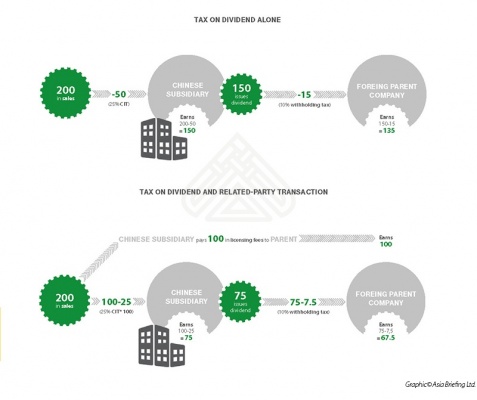

How Does Transfer Pricing Work

- January 2016

- Members Access

Tax on dividend alone and tax on dividend and related-party transaction

infographic

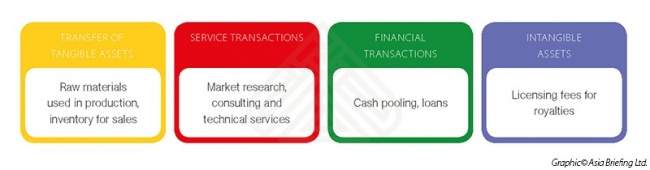

Various Transaction Types Related to Transfer Pricing in China

- January 2016

- Members Access

Various types of transactions are eligible to use in related-party transactions.

infographic

Transfer Pricing Services

- January 2016

- Members Access

Various transfer pricing services in China

Q&A

What are the penalties imposed in Vietnam if a company fails to comply with repo...

- January 2016

- Free Access

If a company fails to comply with VAT regulations and misses the deadline, penalties will be ensued and in many cases profits will also be affected. In addition, a taxpayer who pays tax later than the deadline has to pay the outstanding tax liabiliti...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us