Our collection of resources based on what we have learned on the ground

Resources

partner-publication

DPRK Business Monthly: November 2015

- November 2015

- Members Access

This regular publication looks at current international, domestic, and peninsular affairs concerning North Korea while also offering commentary and tourism information on the country.

magazine

A Single Economic Space From Lisbon to Vladivostok

- November 2015

- Members Access

This issue of Russia Briefing introduces the idea of a single economic space between Lisbon and Vladivostok. It presents the history of this concept as well as the potential benefits if it had been realized.

magazine

Import & Export in Vietnam: settori chiave e accordi di libero scambio

- November 2015

- Members Access

In questo numero di Vietnam Briefing, esaminiamo gli aspetti chiave dell'import e dell'export del Paese, focalizzato sul tessile, sulla telefonia e sulla componentistica delle automobili. Inoltre, analizziamo le opportunità per il Vietnam alla...

report

Company Deregistration in China

- November 2015

- Members Access

Closing down a company requires both time and cost â simply walking away might seemingly save the investor these expenses in the short term. However, for investors with a future perspective on doing business in China or looking to close potentia...

partner-publication

Asia Light Manufacturing Outlook: November 2015

- November 2015

- US $40

The November Issue of the Asia Light Manufacturing Outlook report is a 4-5 page executive-ready assessment and outlook designed to help companies anticipate labor risks and dynamics across key manufacturing countries in Asia. Countries of coverage in...

infographic

Annual Compliance Timeline - Annual Audit in China

- November 2015

- Free Access

This infographic shows the timeline of the annual audit process in China.

infographic

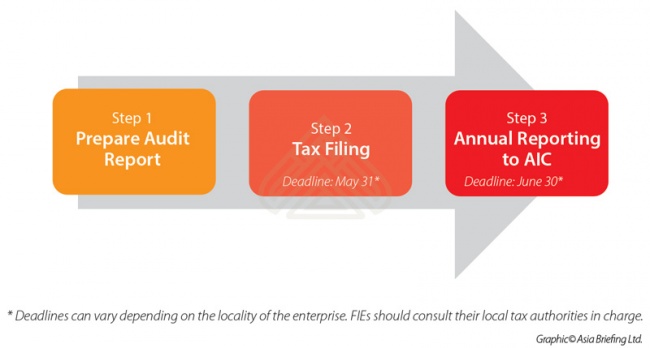

Steps of preparing the annual audit in China

- November 2015

- Free Access

This infographic shows steps of preparing the annual audit in China - from preparing the report to reporting to AIC.

partner-publication

Business Now November 2015

- November 2015

- Members Access

The November issue of Business Now puts the spotlight on One Belt, One Road. Everyone is eager to talk about it, but how can American businesses benefit from this initiative? A package of three stories about the new Silk Road puts the initiative in i...

partner-publication

Business Now October 2015

- October 2015

- Members Access

Human resources has become a major challenge for many companies adjusting to the new normal. In the October issue, AmCham China members share the sense of urgency to become strategic within HR departments. Listen to what HR directors from ConocoPhill...

partner-publication

EURObiz - September/ October 2015

- October 2015

- Members Access

This issue of EURObiz focuses on IPR in China. The issue of IPR is common thread that runs through every part of todayâs knowledge-intensive economy. A functioning IPR system is one of the most important building-blocks that China needs to succe...

partner-publication

DPRK Business Monthly: October 2015

- October 2015

- Members Access

This regular publication looks at current international, domestic, and peninsular affairs concerning North Korea while also offering commentary and tourism information on the country.

guide

Selling, Sourcing and E-Commerce in China 2016 (First Edition)

- October 2015

- US $19.99

Selling, Sourcing & E-Commerce in China 2016, produced in collaboration with the experts at Dezan Shira & Associates, provides a comprehensive analysis of all the aspects of commerce in China. It discusses how foreign companies can best go about sour...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us