Our collection of resources based on what we have learned on the ground

Resources

BIT

Bilateral Investment Treaty between Tajikistan and Vietnam

- September 2015

- Free Access

Bilateral Investment Treaty between Tajikistan and Vietnam

BIT

Bilateral Investment Treaty between Venezuela and Vietnam

- September 2015

- Free Access

Bilateral Investment Treaty between Venezuela and Vietnam

magazine

China’s Silk Road Economic Belt

- September 2015

- Members Access

China's Silk Road Economic Belt is the largest and most ambitious undertaking yet proposed by Beijing. With financing and the value of resources across Eurasia running into hundreds of billions of dollars, we outline the fundamentals of Chinaâs ...

partner-publication

Asia Light Manufacturing Outlook: September 2015

- September 2015

- US $40

The September Issue of the Asia Light Manufacturing Outlook report is a 4-5 page executive-ready assessment and outlook designed to help companies anticipate labor risks and dynamics across key manufacturing countries in Asia. Countries of coverage i...

infographic

Trans-Asia Railway Network

- September 2015

- Free Access

This infographic shows the Trans-Asia Railway project - how China will be connected with South-East Asia in terms of railway network.

infographic

The Eastern Route - China-Vietnam-Cambodia (Railway)

- September 2015

- Free Access

This infographic shows the Eastern railway route: China-Vietnam-Cambodia.

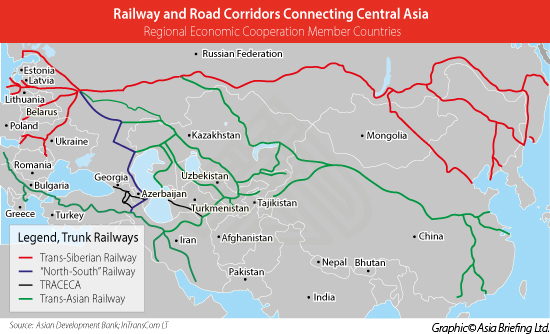

infographic

Railway and Road Corridors Connecting Central Asia

- September 2015

- Free Access

This infographic shows railway and road corridors connecting Central Asia - such as, Trans-Siberian, North-South, TRACECA and Trans-Asian railway.

infographic

Silk Road Overland & Maritime Route Map

- September 2015

- Free Access

This infographic shows the Silk Road sea route and Silk Road land route.

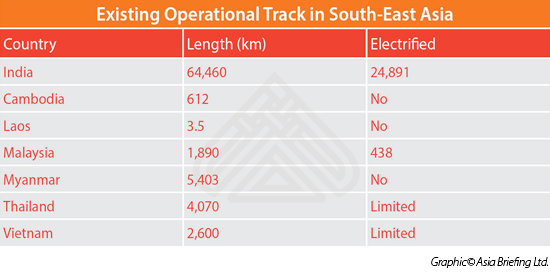

infographic

Existing Operational Track in South-East Asia

- September 2015

- Free Access

This infographic shows the list of the countries in South-East Asia, length (km) and electrified situation of each country in terms of operational track.

partner-publication

Business Now September 2015

- September 2015

- Members Access

The September issue spotlights healthcare in China, from how new indoor smoking bans are helping business to the regulations impacting the medical device and pharmaceutical industries. In the latest installment of our In-Depth Interview series, Unite...

BIT

Bilateral Investment Treaty between Philippines and Myanmar

- August 2015

- Free Access

Bilateral Investment Treaty between Philippines and Myanmar

partner-publication

Business Now August 2015

- August 2015

- Members Access

Innovation â itâs the secret ingredient China hopes to add to its economic rise. It stands as a national imperative, a prerequisite for moving up in global dominance. This issue highlights a few of the many ways Americans and American compa...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us