Our collection of resources based on what we have learned on the ground

Resources

magazine

The FAST-TRACK to Market Entry: Outstaffing

- August 2015

- Members Access

This issue of Russia Briefing gives advice on entering the Russian market including means of setting up a business and dealing with barriers of entry. For a foreign company entering a CIS country, for instance the barriers for a typical business setu...

DTA

Double Taxation Avoidance Agreement between Myanmar and India

- August 2015

- Free Access

Double Taxation Avoidance Agreement between Myanmar and India

DTA

Double Taxation Avoidance Agreement between Myanmar and U.K.

- August 2015

- Free Access

Double Taxation Avoidance Agreement between Myanmar and U.K.

DTA

Double Taxation Avoidance Agreement between Philippines and India

- August 2015

- Free Access

Double Taxation Avoidance Agreement between Philippines and India

DTA

Double Taxation Avoidance Agreement between Philippines and Austria

- August 2015

- Free Access

Double Taxation Avoidance Agreement between Philippines and Austria

DTA

Double Taxation Avoidance Agreement between Philippines and China

- August 2015

- Free Access

Double Taxation Avoidance Agreement between Philippines and China

DTA

Double Taxation Avoidance Agreement between Philippines and China Protocol

- August 2015

- Free Access

Double Taxation Avoidance Agreement between Philippines and China Protocol

DTA

Double Taxation Avoidance Agreement between Myanmar and Malaysia

- August 2015

- Free Access

Double Taxation Avoidance Agreement between Myanmar and Malaysia

webinar

Transition from Representative Office (RO) to Wholly Foreign-Owned Enterprise (W...

- August 2015

- Free Access

Would your China business benefit from the transition from Representative Office to Wholly Foreign-Owned Enterprise? Stephen O’Regan , Associate in Dezan Shira & Associates' Guangzhou office, discusses the benefits and challenges of the transition...

partner-publication

EURObiz - July/ August 2015

- August 2015

- Members Access

For China to achieve the necessary shift to qualitative, sustainable growth required to rebalance its economy, creating the conditions for innovation to flourish will be essential. In this issue of EURObiz we look at the starting point for Chinaâ�...

partner-publication

Asia Light Manufacturing Outlook: August 2015

- August 2015

- US $40

The August Issue of the Asia Light Manufacturing Outlook report is a 4-5 page executive-ready assessment and outlook designed to help companies anticipate labor risks and dynamics across key manufacturing countries in Asia. Countries of coverage incl...

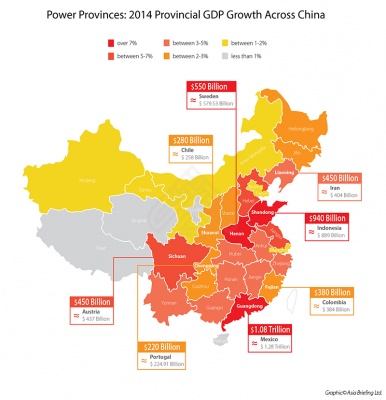

infographic

Powerful Provinces: 2014 Provincial GDP Growth Across China

- August 2015

- Free Access

This infographic shows GDP of provinces across China and comparisons with countries that have relevant amount across the world.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us