Our collection of resources based on what we have learned on the ground

Resources

magazine

Investing in Vietnam: Corporate Entities, Governance and VAT

- July 2015

- Members Access

In this issue of Vietnam Briefing, we highlight the forms of corporate presence available to foreign investors in Vietnam. We take a look at the countryâs system of corporate governance, and discuss how the form of presence a company chooses aff...

partner-publication

ASEAN Business Optimism Index: Quarter 3 2015

- July 2015

- Members Access

The ASEAN Business Optimism Index is published quarterly by Dun & Bradstreet. It is the first and only business confidence index for the ASEAN economic bloc, comprising six countries namely Indonesia, Malaysia, Philippines, Singapore, Thailand and Vi...

partner-publication

Asia Light Manufacturing Outlook: July 2015

- July 2015

- US $40

The July Issue of the Asia Light Manufacturing Outlook report is a 4-5 page executive-ready assessment and outlook designed to help companies anticipate labor risks and dynamics across key manufacturing countries in Asia. Countries of coverage includ...

infographic

Import & Export Taxes in China

- July 2015

- Free Access

This infographic shows import taxes and the process of calculation and export VAT rebates and the process of calculation.

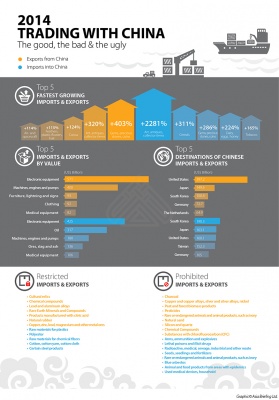

infographic

Exports & Imports of China - Trading with China in 2014

- July 2015

- Free Access

This infographic shows top 5 fastest growing imports & exports, importers & exporters by value and destinations.

infographic

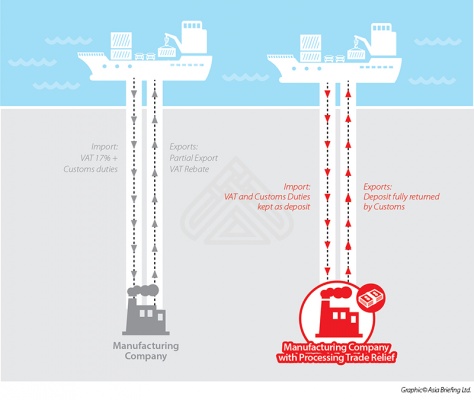

Processing Trade Relief in China

- July 2015

- Free Access

This infographic shows the process of trade relief in China by comparing the two models - 1. Processing of consigned imported material and 2. Processing of purchased imported materials.

infographic

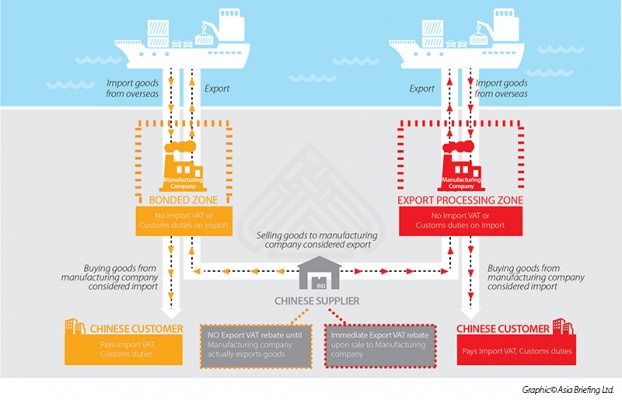

Foreign Investment Zones and its processes in China

- July 2015

- Free Access

This infographic shows processes of export processing zones in China. The parties are Chinese customer and Chinese supplier - explained in both ways; bounded zone and export processing zone.

infographic

India's License and Registration eBiz Portal's Services

- July 2015

- Free Access

This infographic displays all the services provided by India's new government to business eBiz portal.

infographic

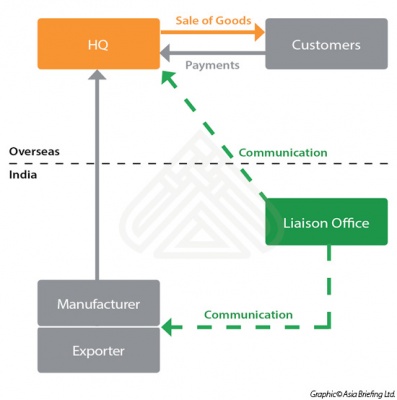

The Function of a Liaison Office in India

- July 2015

- Free Access

This infographic shows the communicative function a liaison office has when set-up in India.

infographic

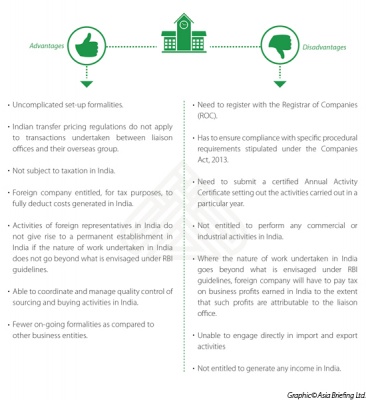

The Advantages & Disadvantages of Running a Liaison Office in India

- July 2015

- Free Access

This infographic outlines the several advantages and disadvantages related to running a liaison office in India.

magazine

How to Establish a Business in India: Choosing a Low-Risk Entry Model

- June 2015

- Members Access

In this issue of India Briefing Magazine, we explore market entry options that allow foreign investors to test the water before diving into the Indian market. In the first article, we examine the governmentâs new eBiz portal. This portal provide...

Q&A

How does India’s eBiz Portal work?

- June 2015

- Free Access

Services on the eBiz Portal can be accessed only after registering through a two-step process. The first step requires entrepreneurs to login as individuals to receive login credentials, while the second step requires registering the business to acce...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us