Our collection of resources based on what we have learned on the ground

Resources

infographic

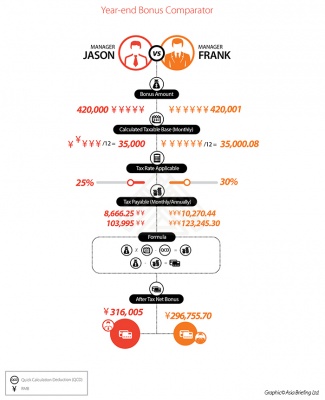

China's Year-end Bonus Comparator

- April 2017

- Members Access

The infographic illustrates the year-end bonus calculation by comparing two different possible scenarios.

infographic

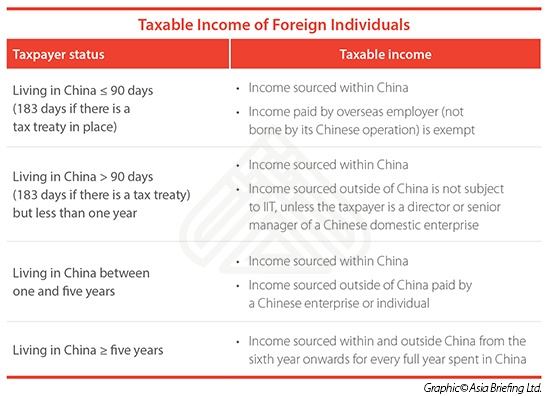

Taxable Income of Foreign Individuals in China

- April 2017

- Members Access

This table shows the taxable income of foreign individuals working in China by taxpayer status.

infographic

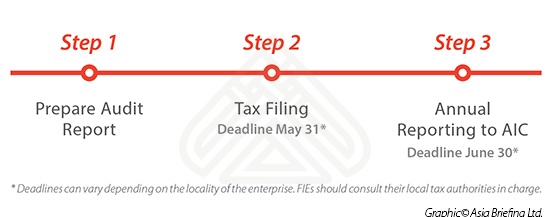

Annual Tax Compliance in China Steps and Deadlines

- April 2017

- Members Access

The table shows deadlines and steps to follow in order to be compliant with taxation in China.

infographic

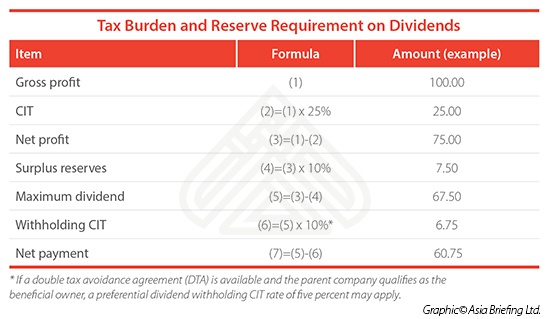

China's Tax Burden and Reserve Requirement on Dividends

- April 2017

- Members Access

This table displays China's tax burden and reserve requirement on dividends.

infographic

China's Service Fees

- April 2017

- Members Access

Service fees paid to overseas related parties are deductible for CIT purposes provided they are directly related to the FIE's business operations and charged at normal market rates.

infographic

China's Royalty Remittances

- April 2017

- Members Access

Royalties are fees paid in relation to the use of intellectual property, such as trademarks, patents, copyrights, and proprietary technology.

infographic

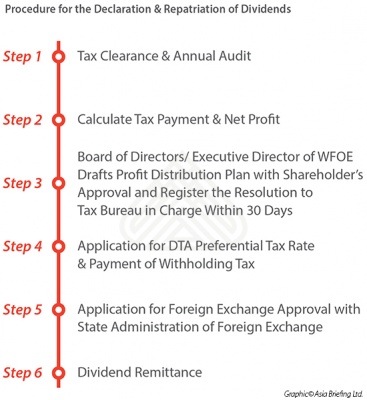

Procedure for the Declaration & Repatriation of Dividends in China

- April 2017

- Members Access

The table shows the procedure to follow when repatriating dividends in China.

infographic

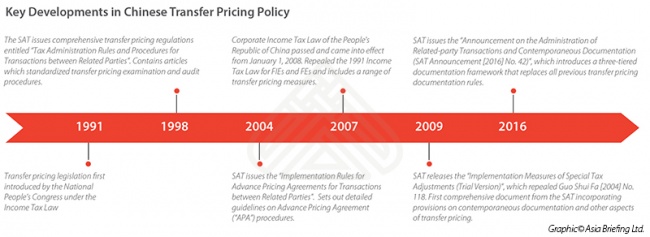

Key Developments in China's Transfer Pricing Policy

- April 2017

- Members Access

This timeline shows the development of China's Transfer Pricing policy from 1991 to date.

infographic

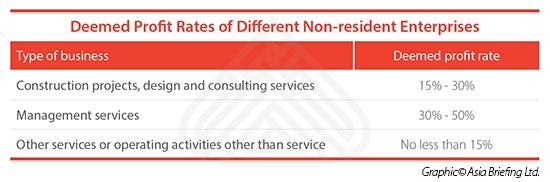

Deemed Profit Rates of Different Non-resident Enterprises in China

- April 2017

- Members Access

This table displays the range of deemed profit rates that the tax authorities will apply depending on the nature of the non-resident enterprise’s business.

infographic

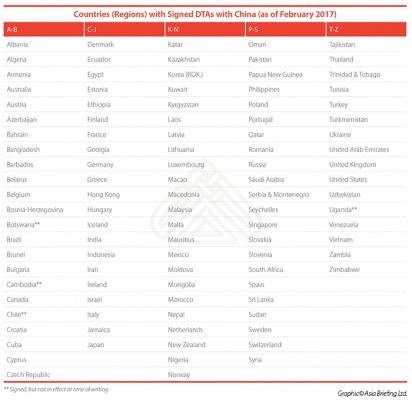

Countries Holding Double Tax Agreements With China

- April 2017

- Members Access

The table shows the countries (regions) with signed DTAs with China (as of February 2017).

infographic

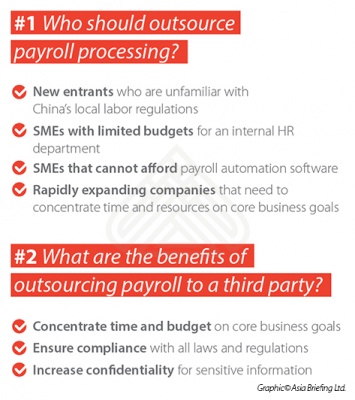

Who Should Outsource Payroll Processing and the Benefits of Outsourcing to a Thi...

- April 2017

- Free Access

This infographic advises on who should outsource payroll processing and what the advantages are of outsourcing to a third party.

infographic

Single Function HR & Payroll Software Solutions

- April 2017

- Free Access

This infographic shows some of the main points which can be stored and calculated using single function HR and Payroll software.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us