Our collection of resources based on what we have learned on the ground

Resources

DTA

Agreement Between The Government Of The Republic Of Singapore And The Government...

- June 2015

- Free Access

Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Singapore and Latvia.

DTA

Agreement Between The Republic Of Singapore And The Principality Of Liechtenstei...

- June 2015

- Free Access

Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Singapore and Liechtenstein.

DTA

Agreement Between The Government Of The Republic Of Singapore And The Government...

- June 2015

- Free Access

Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Singapore and Luxembourg.

DTA

Agreement Between The Republic Of Singapore And The Kingdom Of Morocco For The A...

- June 2015

- Free Access

Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Singapore and Morocco.

DTA

Agreement Between The Government Of The Republic Of Singapore And The Government...

- June 2015

- Free Access

Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income between Singapore and Lao.

Q&A

What does it mean for a company to be dormant?

- June 2015

- Free Access

There is no official term used to express a company’s state of dormancy in Chinese corporate law. However, for a company to become dormant, it must temporarily bring its activities to a halt. A reduction of operations may seem detrimental, but ...

infographic

Investment & Business Trends in China

- June 2015

- Free Access

This infographic shows brief investment and business trends in China - such as FDI inflow, expansion of American businesses, rising costs, profit margin.

infographic

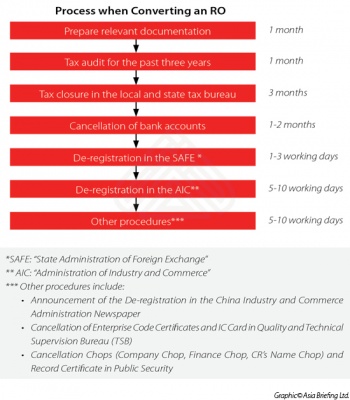

Process When Converting a RO in China

- June 2015

- Free Access

7 steps to follow when converting a RO in China - from preparing the document to cancelling chops and security of the company.

infographic

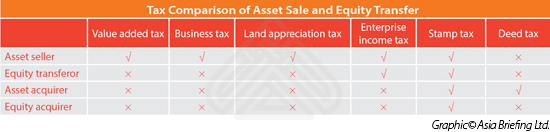

Tax Comparison of Asset Sale and Equity Transfer in China

- June 2015

- Free Access

This infographic shows which tax is needed to be applied to asset seller, equity transferor, asset acquirer and equity acquirer in China.

infographic

Process When De-registering Business in China

- June 2015

- Free Access

This infographic shows 17 steps to follow when de-registering business in China. From submitting termination application to cancelling chops and certificates of the business.

videographic

What You CAN and What You CAN'T Invest in China, Vietnam, and India

- May 2015

- Free Access

This prezi leads you through the foreign investment restrictions in various industries in China, Vietnam, and India

infographic

Foreign Investment in China, India and Vietnam

- May 2015

- Free Access

This infographic shows you the basic statistics about foreign investment in China, India and Vietnam.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us