Our collection of resources based on what we have learned on the ground

Resources

infographic

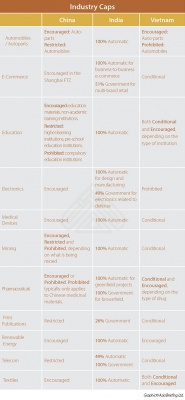

Comparison of Industry Caps in China, India and Vietnam

- May 2015

- Members Access

This infographic compares the foreign investment restrictions on various industries in China, India, and Vietnam.

infographic

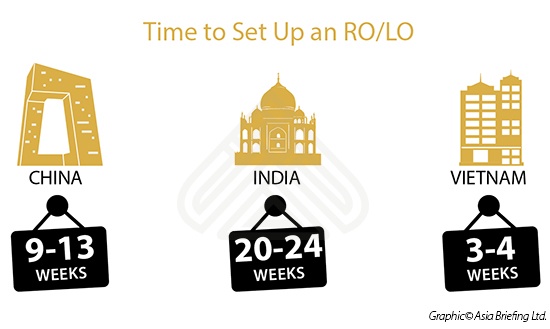

Time to Set Up an Representative Office / Liaison Office in China, India and Vie...

- May 2015

- Free Access

This infographic shows you the time to set up a Representative Office/Liaison Office in China, Vietnam, and India.

infographic

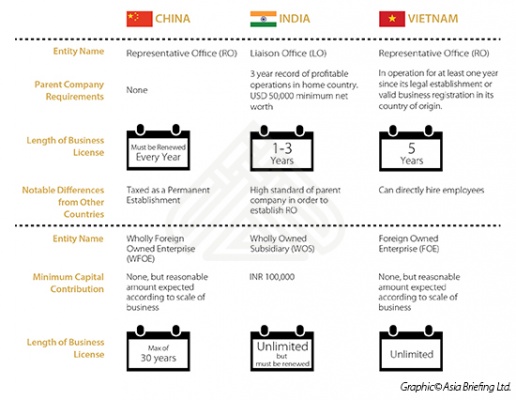

Comparison of Investment Options in China, India, and Vietnam

- May 2015

- Members Access

This infographic compares the different investment models available for foreign investors in China, India, and Vietnam.

infographic

China, India & Vietnam Taxes at a Glance

- May 2015

- Members Access

This infographic compares various tax categories in China, India, and Vietnam.

infographic

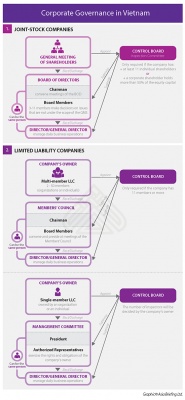

Corporate Governance in Vietnam

- May 2015

- Members Access

This infographic shows the corporate governance for two different enterprise types in Vietnam.

Q&A

What role does the automotive parts industry play in the growth of the Chinese e...

- May 2015

- Free Access

Named as one of the “pillar industries”, the car manufacturing industry is core to China’s economic policy and contributes over 5 percent of the country’s GDP. Car companies benefit from various preferential policies and incen...

Q&A

What steps have the Chinese government taken to improve traffic conditions?

- May 2015

- Free Access

The rapid growth of car use has resulted not only in traffic jams in many of China’s major cities but also in heavy air pollution which has become an everyday concern in recent years. Accordingly, city officials decided to limit the issuing of ...

Q&A

How does the Chinese government regulate foreign investment in the automotive in...

- May 2015

- Members Access

China maintains a list of regulations regarding foreign investment in certain sections of its economy in a document known as the Catalogue for the Guidance of Foreign Investment. It defines foreign investment in certain industries as either enc...

Q&A

What type of market structure does the car manufacturing industry in China exhib...

- May 2015

- Members Access

At large, the car manufacturing industry exhibits a lopsided structure. Thousands of small companies make up the auto parts sector, thus, forming a highly fragmented car parts supply market. However, there are only a few car assemblers at the e...

Q&A

What are some of the special treatments which automotive parts manufacturers can...

- May 2015

- Free Access

The Shanghai Government released its own Negative List specifically for foreign investment in the Free Trade Zone. While the manufacturing of finished cars is still prohibited in this list as in the universal Catalogue, the latest Negative List relea...

Q&A

What is the licensing process for auto parts producers in China?

- May 2015

- Free Access

A Production License is required by the Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) if a company wishes to engage in the production of certain auto parts in China. Specifically speaking, the company needs to submit the ap...

Q&A

Which car parts are subject to consumption tax in China?

- May 2015

- Free Access

Vehicle tires, small and medium-sized commercial vehicles and passenger vehicles with cylinders are all subject to consumption tax. The current CT regime requires that only producers, importers and subcontractors pay CT when they sell a taxable produ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us