Our collection of resources based on what we have learned on the ground

Resources

Q&A

Do foreign nationals working in Singapore have to contribute to Singapore's soci...

- June 2017

- Members Access

Employers are exempted from making Central Provident Fund (CPF) contributions for foreign employees on an employment/professional visit pass or work permit. CPF is Singapore’s comprehensive social security scheme that addresses home-ownership, ...

magazine

Payroll Processing and Compliance in Singapore

- June 2017

- Members Access

In this issue of ASEAN Briefing, we discuss payroll processing and reporting in Singapore as well as analyze the options available for foreign companies looking to centralize their ASEAN payroll processes. We begin by discussing the various regulatio...

Q&A

What are the types of pension offered monthly in India?

- May 2017

- Free Access

Widows' pension for death while in service. Pension uppon superannuation or disability. Orphan's pension. Children's pension. It should be noted that there are different pension funds for seamen, civil servants, employees in tea plantations i...

Q&A

What is the role of minimum wages in Vietnam's payroll compliance?

- May 2017

- Members Access

Vietnam’s minimum wage rates play a significant role in payroll compliance: they provide a basis for the calculation of individual income tax and assist in the determination of social insurance payments. Currently, there are two kinds of minimu...

Q&A

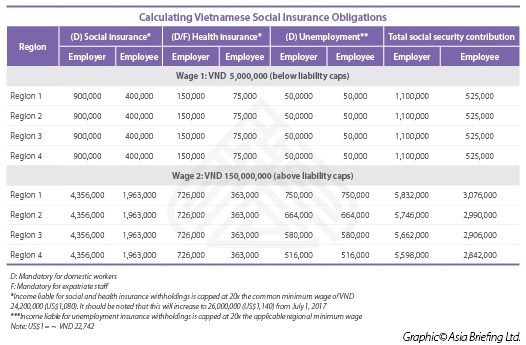

What are the types of mandatory social security in Vietnam?

- May 2017

- Members Access

There are three types of mandatory social security in Vietnam that must be covered by foreign enterprises seeking to hire local staff: social insurance; health insurance; and unemployment insurance. Minimum contributions are required by both the empl...

Q&A

How does Vietnam’s social security system differ for domestic and internationa...

- May 2017

- Members Access

Social and unemployment insurances are mandatory only for Vietnamese employees, whereas health insurance applies to both Vietnamese and foreign workers employed in accordance with Vietnam’s Labor Code. Employers register and pay insurance contr...

Q&A

Which deductions can be made from an employee's salary according to the Vietname...

- May 2017

- Members Access

Currently, the following deductions are permitted under the Vietnamese tax code: Personal allowances of VND 9 million (US$395); Dependent allowances of VND 3.6 million (US$158) per dependent; All mandatory contributions to Vietnam’s social...

Q&A

What are the main benefits of outsourcing payroll for companies in Vietnam?

- May 2017

- Members Access

Savings are now kicking in in Vietnam as companies can handle their HR processes remotely. Yet, the main motivation for companies to choose an outsourced model is the ability to achieve more consistency in data management, greater transparency for ma...

magazine

Payroll Management in Vietnam

- May 2017

- Members Access

In this edition of Vietnam Briefing, we discuss Vietnam’s current statutory requirements regarding payment, social insurance withholdings, and individual income taxation. We go on to explain the areas where compliance is likely to become a concern ...

infographic

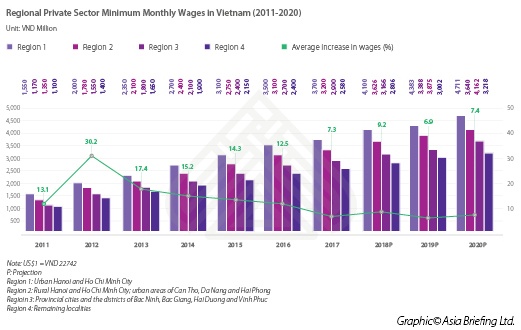

Regional Private Sector Minimum Monthly Wages in Vietnam

- May 2017

- Members Access

This graph shows the regional minimum monthly wages in Vietnam's private sector.

infographic

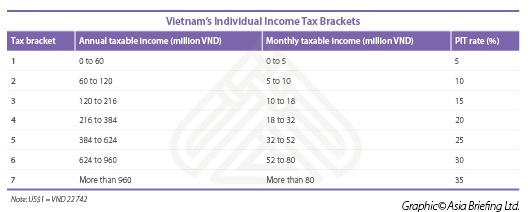

Vietnam's Individual Income Tax Brackets

- May 2017

- Members Access

This table shows Vietnam's individual income tax brackets.

infographic

Vietnamese Social Insurance Obligations Calculation

- May 2017

- Members Access

This table shows how to calculate social security obligations in Vietnam.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us