Our collection of resources based on what we have learned on the ground

Resources

infographic

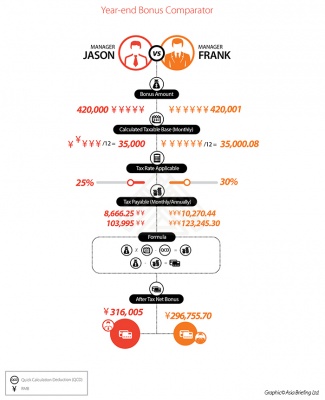

China's Year-end Bonus Comparator

- April 2017

- Members Access

The infographic illustrates the year-end bonus calculation by comparing two different possible scenarios.

infographic

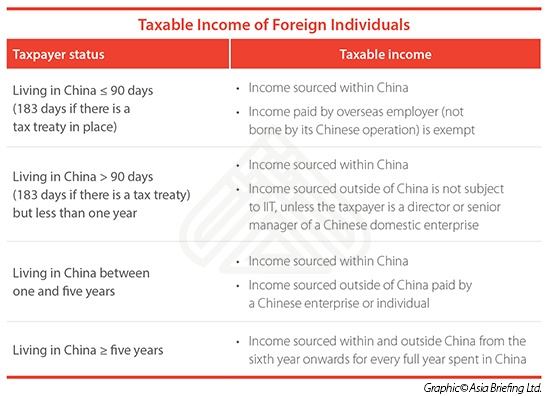

Taxable Income of Foreign Individuals in China

- April 2017

- Members Access

This table shows the taxable income of foreign individuals working in China by taxpayer status.

magazine

Payroll Processing in China: Challenges and Solutions

- April 2017

- Members Access

Businesses in China have a diverse array of HR and payroll needs, but what different industries have in common is the need to grapple with China’s complex and idiosyncratic payroll environment. In this issue of China Briefing magazine, we begin by ...

Q&A

How is China's social security system structured?

- April 2017

- Members Access

China’s social security system is composed of five different insurance types plus one mandatory housing fund scheme. Each has different contribution rates for employers and employees. Employers need to contribute on behalf of every employee, bu...

Q&A

What are the consequences of social security offences committed by employers in ...

- April 2017

- Members Access

Starting from January 2017, labor and social security offences committed by employers – including “failure to pay employees’ remuneration without reason” or “failure to pay or enroll in social insurance premiums” &...

infographic

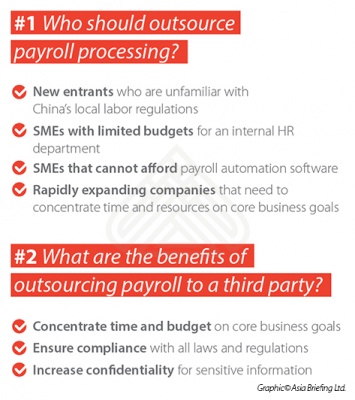

Who Should Outsource Payroll Processing and the Benefits of Outsourcing to a Thi...

- April 2017

- Free Access

This infographic advises on who should outsource payroll processing and what the advantages are of outsourcing to a third party.

Q&A

How can IT solutions help improve efficiency in payroll processing in China?

- April 2017

- Free Access

The HR and payroll processes of many companies operating in China are still paperbased or recorded on obsolete digital archives. Single function software such as tax processing programs can thus be a solution for both small and medium enterprises, bu...

infographic

Single Function HR & Payroll Software Solutions

- April 2017

- Free Access

This infographic shows some of the main points which can be stored and calculated using single function HR and Payroll software.

Q&A

What are the benefits of outsourcing payroll processing in China to a third part...

- April 2017

- Members Access

New market entrants, SMEs with limited budget and rapidly expanding companies are particularly advised to outsource their payroll processing. By outsourcing payroll, businesses can increase its accuracy, decrease the room for errors that may cause re...

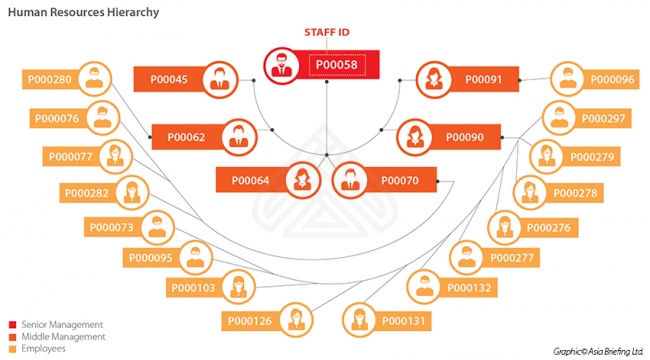

infographic

The Human Resources Hierarchy

- April 2017

- Members Access

This infographic explains how the hierarchy structure works in human resources from senior management and finally to basic employee level.

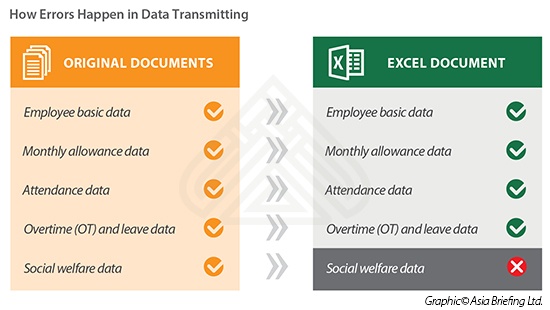

infographic

How Errors Happen in Data Transmitting

- April 2017

- Free Access

This infographic shows some of the errors which could happen when transferring original documents to an excel sheet including employee basic data, monthly allowance data, attendance data, etc.

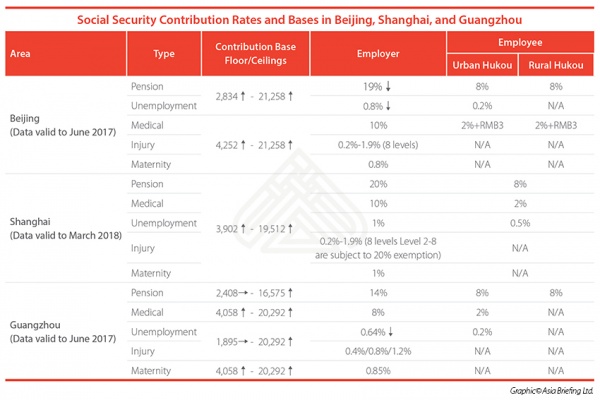

infographic

Social Security Contribution Rates and Bases in Beijing, Shanghai, and Guangzhou

- April 2017

- Members Access

This table shows the social security contribution rates in Beijing, Shanghai, and Guangzhou.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us