Our collection of resources based on what we have learned on the ground

Resources

infographic

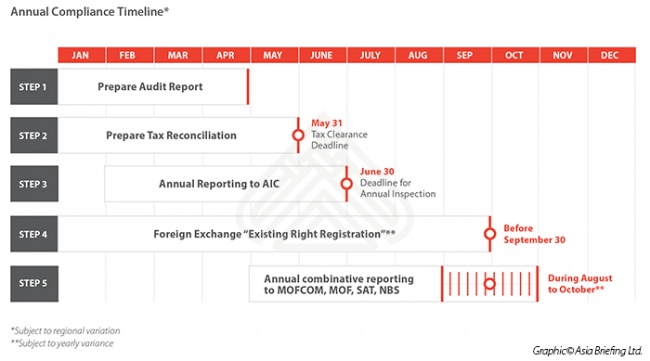

Annual Tax Compliance in China Timeline

- April 2017

- Members Access

This is an illustration of the annual tax compliance in China timeline.

infographic

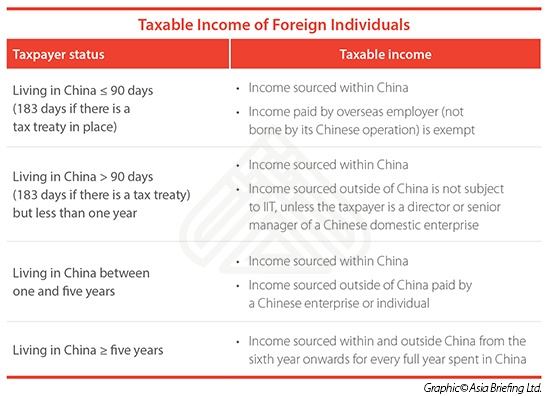

Taxable Income of Foreign Individuals in China

- April 2017

- Members Access

This table shows the taxable income of foreign individuals working in China by taxpayer status.

infographic

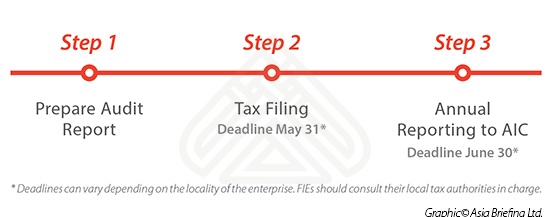

Annual Tax Compliance in China Steps and Deadlines

- April 2017

- Members Access

The table shows deadlines and steps to follow in order to be compliant with taxation in China.

infographic

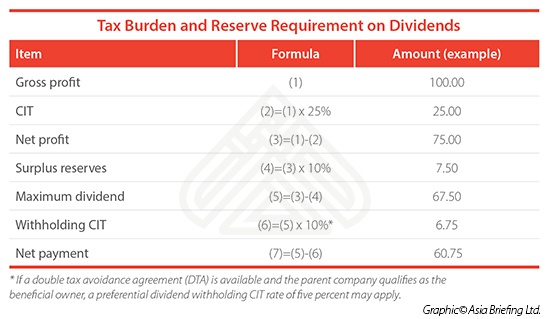

China's Tax Burden and Reserve Requirement on Dividends

- April 2017

- Members Access

This table displays China's tax burden and reserve requirement on dividends.

infographic

China's Service Fees

- April 2017

- Members Access

Service fees paid to overseas related parties are deductible for CIT purposes provided they are directly related to the FIE's business operations and charged at normal market rates.

infographic

China's Royalty Remittances

- April 2017

- Members Access

Royalties are fees paid in relation to the use of intellectual property, such as trademarks, patents, copyrights, and proprietary technology.

infographic

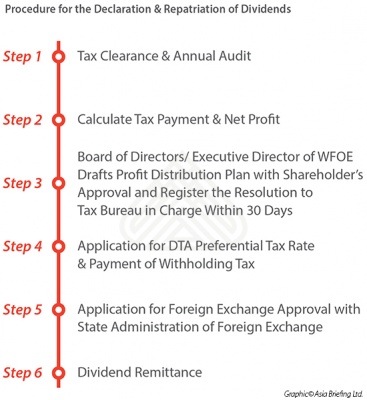

Procedure for the Declaration & Repatriation of Dividends in China

- April 2017

- Members Access

The table shows the procedure to follow when repatriating dividends in China.

infographic

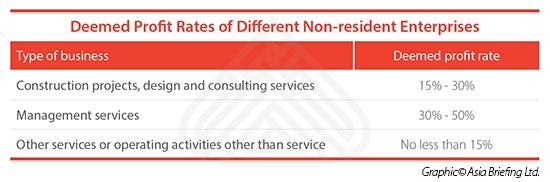

Deemed Profit Rates of Different Non-resident Enterprises in China

- April 2017

- Members Access

This table displays the range of deemed profit rates that the tax authorities will apply depending on the nature of the non-resident enterprise’s business.

infographic

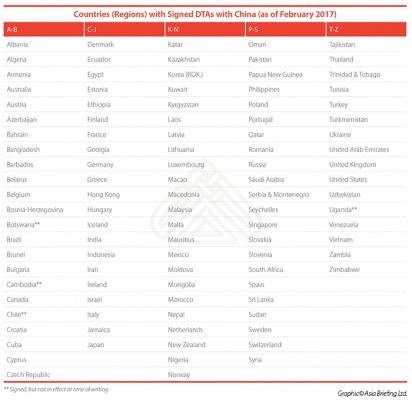

Countries Holding Double Tax Agreements With China

- April 2017

- Members Access

The table shows the countries (regions) with signed DTAs with China (as of February 2017).

Q&A

How is China's social security system structured?

- April 2017

- Members Access

China’s social security system is composed of five different insurance types plus one mandatory housing fund scheme. Each has different contribution rates for employers and employees. Employers need to contribute on behalf of every employee, bu...

infographic

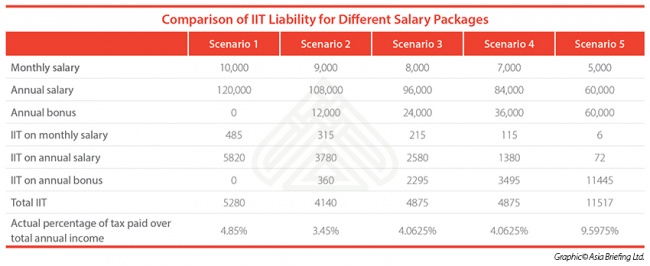

Comparison of IIT Liability for Different Salary Packages

- April 2017

- Members Access

This infographic shows how IIT liability varies depending on the monthly or annual salary and annual bonus.

infographic

Taxable Income of Foreign Individuals

- April 2017

- Free Access

The infographic above explains the income sourced within China from less than 90 days starting from income sourced within China

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us