Our collection of resources based on what we have learned on the ground

Resources

partner-publication

The 2013 U.S. Commercial Service China Business Handbook

- January 2013

- Members Access

Asia Briefing has proudly cooperated with the U.S. Commercial Service to publish the 2013 edition of the China Business Handbook, with chapters contributed by selected foreign investment firms, including Dezan Shira & Associates.

infographic

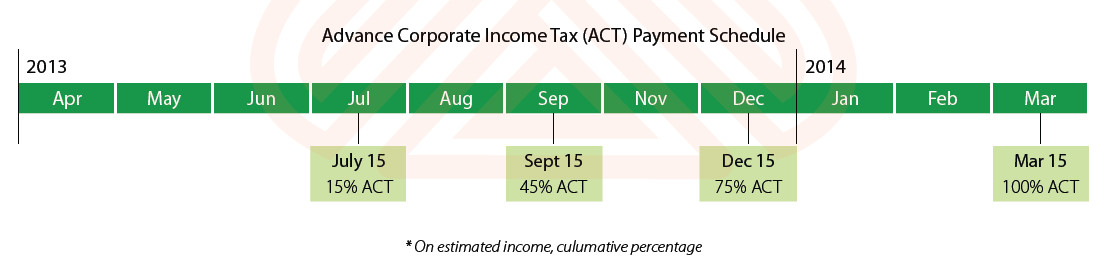

Advance Corporate Income Tax (ACT) Payment Schedule for Indian

- January 2013

- Members Access

The timeline shows the payment schedule of Advance Corporate Income Tax (ACT) for Indian companies.

infographic

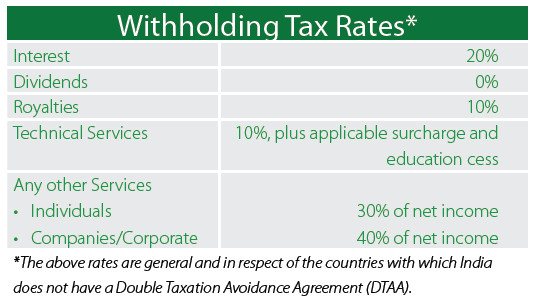

Withholding Tax Rates in India

- January 2013

- Free Access

The table outlines the percentage of withholding tax rates in India.

infographic

Individual Income Tax Rates 2013-14 in India

- January 2013

- Free Access

A table comparing the individual income tax rates in India between 2013-14 and in 2012-13

Q&A

What is ASEAN?

- January 2013

- Free Access

ASEAN is an acronym for the Association of Southeast Asian Nations. The Association is founded in 1967 and is comprised of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. In recent years, the regi...

Q&A

What is Regional Comprehensive Economic Partnership?

- January 2013

- Free Access

Regional Comprehensive Economic Partnership (RCEP) scheme includes ASEAN bloc, China, India, Japan, South Korea, Australia and New Zealand. The aim of this partnership is, when being implemented, to lower customs duties and trade barriers between the...

Q&A

Why is Singapore a good base for Asia expansion?

- January 2013

- Free Access

There are mainly three reasons: Singaporean companies enjoy a low tax rate of 17 percent. There will be no tax payable on dividends earned externally from its borders. It is also possible to operate a Singaporean company as a “shelf” ...

Q&A

What are the requirements for foreign persons to set up companies in Singapore?

- January 2013

- Free Access

Since Singapore does not allow foreign persons to register directly for a company, a professional service firm must be engaged to register on behalf of companies with non-Singapore National Registration Identity Card holders, non-Employment Pass hold...

Q&A

Are there any tax incentive programs in Singapore?

- January 2013

- Free Access

There are a number of these programs, such as Global Trader Program, HQ Program and incentives under Productivity and Innovation Credit Scheme. These are all programs aiming to draw in or encourage investment in Singapore.

Q&A

How does the tax incentive program operate in Singapore?

- January 2013

- Free Access

Take one example, the incentives under Productivity and Innovation Credit Scheme – businesses can get cash payout or a 400 percent tax deduction or allowance on expenditure of up to SG$ 400,000 on each of the following six activities: Purcha...

Q&A

Is share capital required under Singaporean law?

- January 2013

- Free Access

The minimum paid-up capital (equivalent to share capital) is S$1 and the amount of this capital can be increased anytime after the incorporation of the company.

Q&A

What is a registered address for setting Singaporean company?

- January 2013

- Free Access

A physical address in Singapore (be that residential or commercial) must be provided as the registered address of the company. All premises must be approved for business use by the Urban Redevelopment Authority. However, a P.O. box cannot be used as ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us