Our collection of resources based on what we have learned on the ground

Resources

infographic

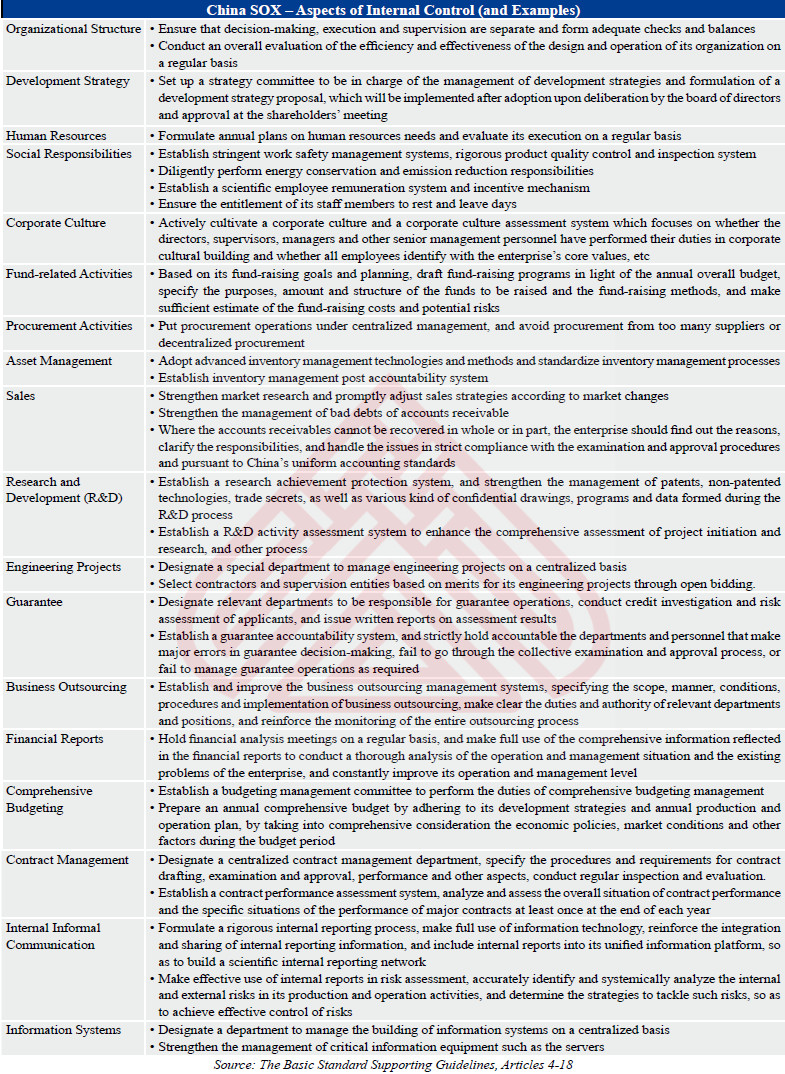

Internal Control of China's Sarbanes-Oxley Act (SOX)

- March 2012

- Free Access

The table shows the aspects and examples of internal control of China's Sarbanes-Oxley Act (SOX).

infographic

Checklist of Internal Control for Fraud Prevention in China

- March 2012

- Free Access

The checklist shows the internal control of legal, financial and operational sector for fraud prevention in China.

partner-publication

DPRK Business Monthly: March 2012

- March 2012

- Members Access

The latest issue of DPRK Business Monthly is now available for complimentary download. The regular magazine looks at current international, domestic, and peninsular affairs concerning North Korea while also offering commentary and tourism information...

magazine

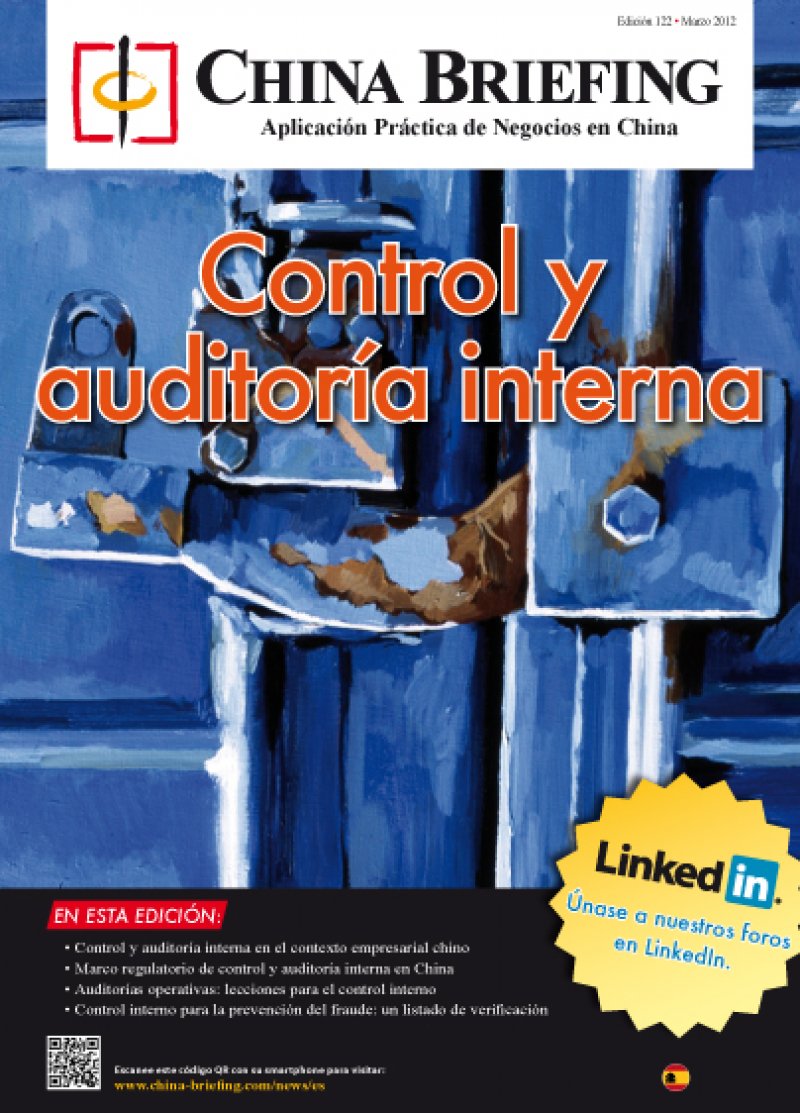

Control y auditoría interna

- March 2012

- Members Access

A medida que más compañÃas dan prioridad a operaciones en China como parte de su estrategia de crecimiento a futuro, los sistemas de control interno poco efectivos ya no son una opción. Como tal, esta edición del China

magazine

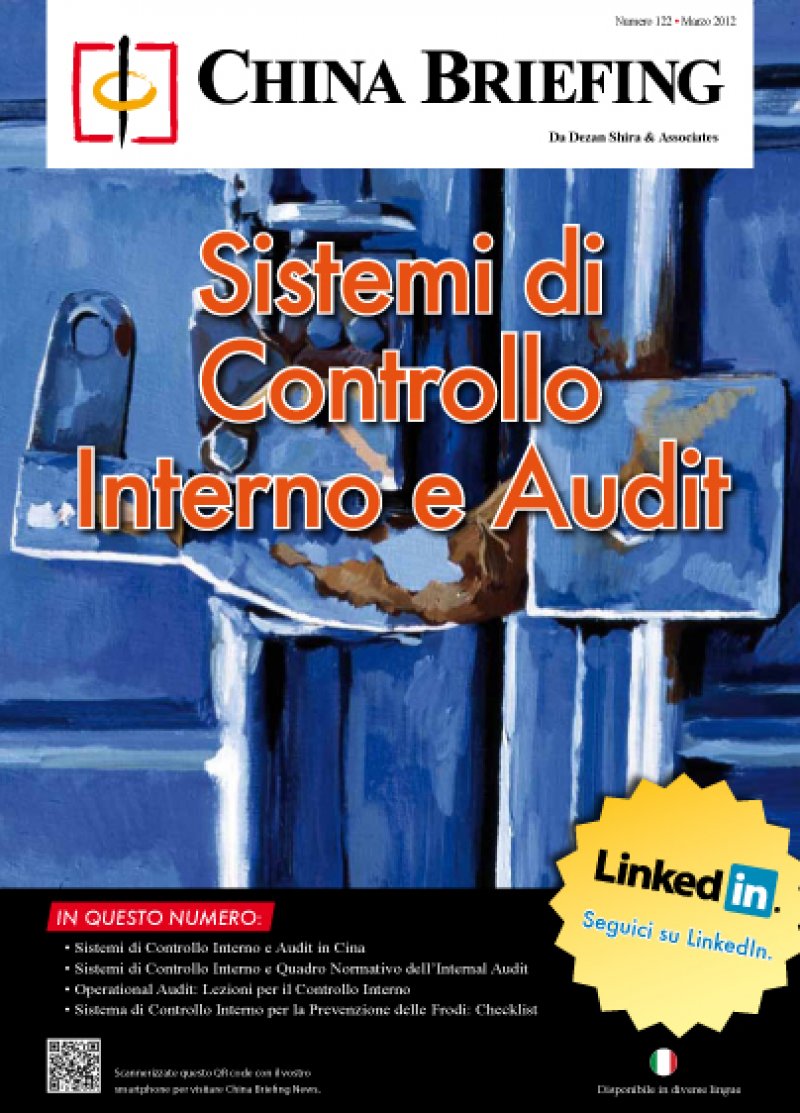

Sistemi di Controllo Interno e Audit

- March 2012

- Members Access

Mentre la strategia di crescita futura di un numero sempre più elevato di aziende ruota attorno ad operazioni condotte in Cina o in Asia, sistemi di controllo interno non sufficientemente efficaci rischiano di compromettere il risultato economico ...

magazine

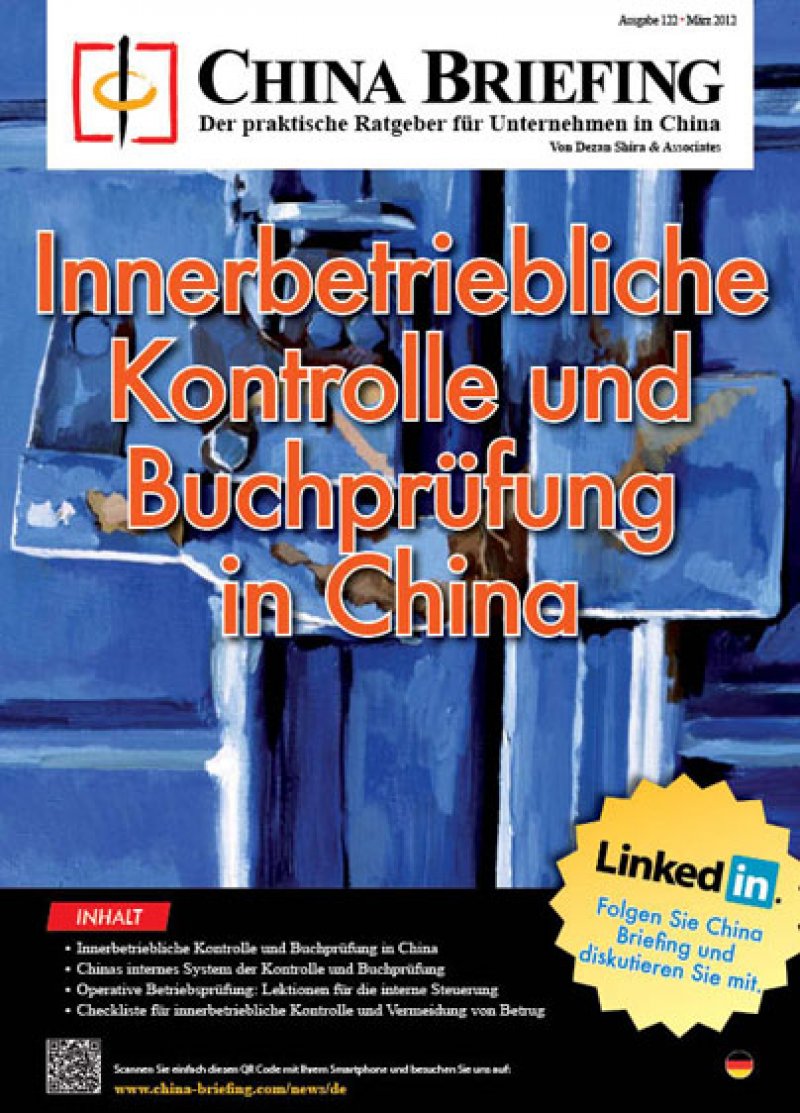

Innerbetriebliche Kontrolle und Audit

- March 2012

- Members Access

Immer mehr Unternehmen betrachten heutzutage ihre Da immer mehr Unternehmen ihr Chinageschäft als zukünftige Wachstumsstrategie priorisieren, sind wirksame interne Kontrollmechanismen in China unabdingbar.

magazine

Contrôle Interne et Audit

- March 2012

- Members Access

Alors que de plus en plus dâentreprises confèrent la priorité de leur stratégie dâexpansion à la Chine, les methods chinoises inefficaces de contrôle interne ne représentent plus une option.

magazine

Internal Control and Audit

- March 2012

- Members Access

As more companies prioritize China operations as part of their future growth strategy, less than effective internal control systems in China are no longer an option.

DTA

Double Taxation Avoidance Agreement between Singapore and Spain

- February 2012

- Free Access

Double Taxation Avoidance Agreement between Singapore and Spain

partner-publication

DPRK Business Monthly Vol. III, No. 1, February 2012

- February 2012

- Members Access

The latest issue of DPRK Business Monthly is now available for complimentary download. The regular magazine looks at current international, domestic, and peninsular affairs concerning North Korea while also offering commentaddry and tourism informati...

infographic

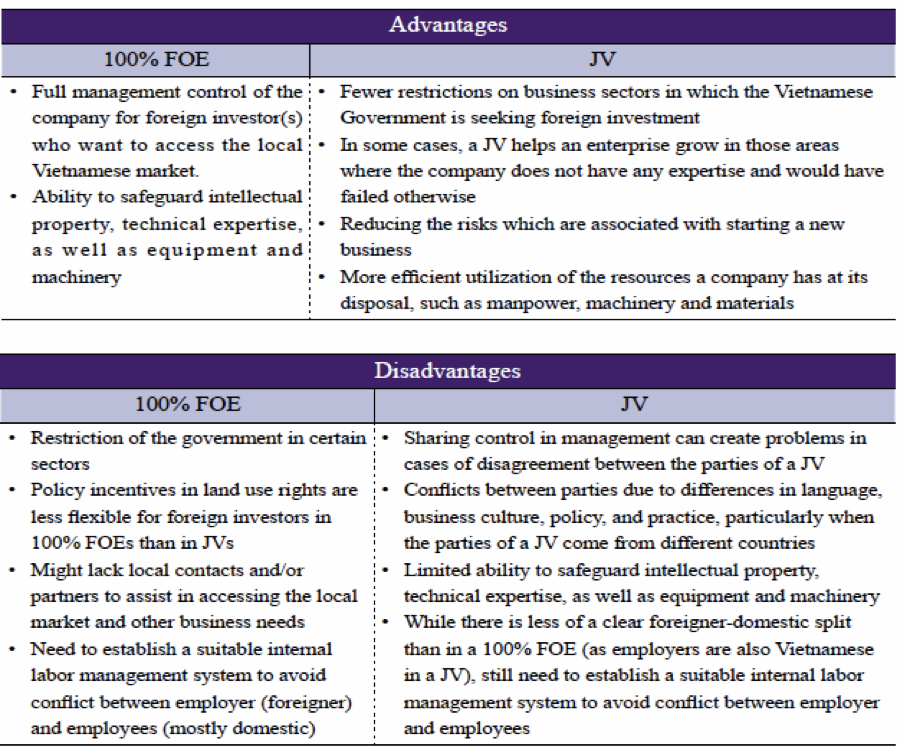

Advantages and Disadvantages of a wholly Foreign-Owned Enterprise (FOE) and Join...

- January 2012

- Free Access

The tables show the advantages and disadvantages of establishing a 100% Foreign-Owned Enterprise (FOE) and a Joint Venture (JV) in Vietnam.

infographic

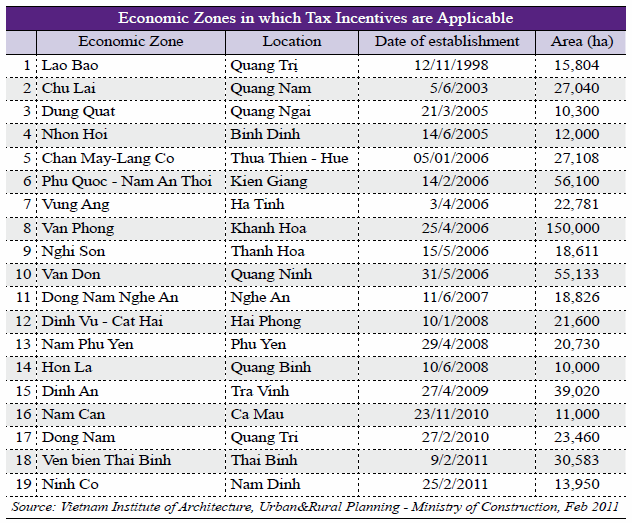

Tax Incentives for Economic Zones in Vietnam

- January 2012

- Free Access

The table outlines the location, date of establishment and area of the economic zones in Vietnam, which tax incentives are applicable.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us