Our collection of resources based on what we have learned on the ground

Resources

presentation

Navigating Complexities: An Introduction to Dezan Shira & Associates in India

- June 2016

- Free Access

This report offers an introduction to Dezan Shira & Associates business services and information platforms for companies seeking to establish themselves in India.

webinar

Come aprire una società commerciale in Vietnam

- June 2016

- Free Access

Erasmo Indolino, International Business Advisory presso l'ufficio di Hanoi di Dezan Shira & Assocates, fornisce informazioni sulla costituzione di una società commerciale in Vietnam.

infographic

Due Diligence Considerations in India at a Glance

- May 2016

- Members Access

India has successfully topped China in terms of FDI investment in 2015, a unique due diligence factors have to be considered during the process.

Q&A

Which governmental bodies and general restrictions should be noted with regard t...

- May 2016

- Members Access

The Ministry of Finance (MOF) and State Bank of Vietnam (SBV) are two main governmental bodies investors have to take note of. MOF has the power to adjust tax rates and regulate remittances, whereas SBV is in charge of regulating banking and fo...

Q&A

Prior to remitting profits, investors may be faced with withholding tax which is...

- May 2016

- Members Access

Currently remittances are segmented into the following four categories: dividends, interest, royalties, and technical service fees. For dividends, no tax is currently imposed unless paid to individuals, whereas interest paid to a non-resident is subj...

Q&A

What are the obligations companies have to fulfill before being able to remit pr...

- May 2016

- Members Access

Companies have to make the following taxes before being able to remit profits: CIT which now has been reduced to 20% for both local and foreign enterprises, except for some special industries; VAT which is imposed at three different rates namely 0%, ...

Q&A

What are the main restrictions when selecting and operating a foreign currency a...

- May 2016

- Members Access

Institutional selection is one of the pressing issues here since investors are limited to the selection of a single account with a bank that has been licensed by the SBV. Only banks with this license can operate a foreign currency account along with ...

Q&A

Why is it best to set up a foreign currency bank account after investors enter V...

- May 2016

- Members Access

A foreign currency bank account has to be utilized for all foreign currency transactions carried out within the country. Further, there are a list of activities that require a foreign currency account which include receipt of charter capital up until...

Q&A

What are some of the restrictions placed on remitting profits in Vietnam?

- May 2016

- Members Access

There are a number of restrictions enforced upon remitting profits. For example, under Vietnamese law, profits may only be remitted once per year. Furthermore, dividends may not be carried out during a year in which a company has not turned a profit....

infographic

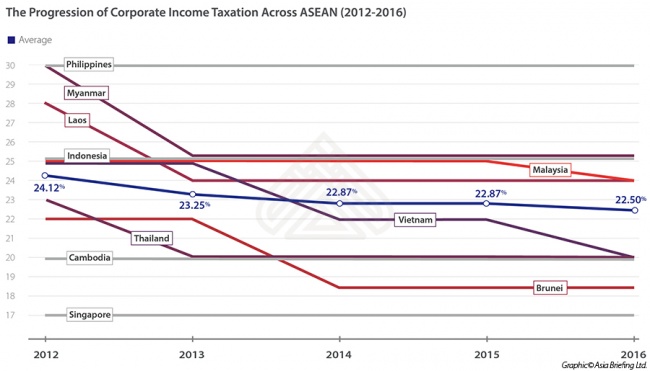

The Progression of Corporate Income Taxation Across ASEAN (2012-2016)

- May 2016

- Members Access

This infographic shows that ASEAN countries have lowered their corporate income taxes in the past decade to attract investment.

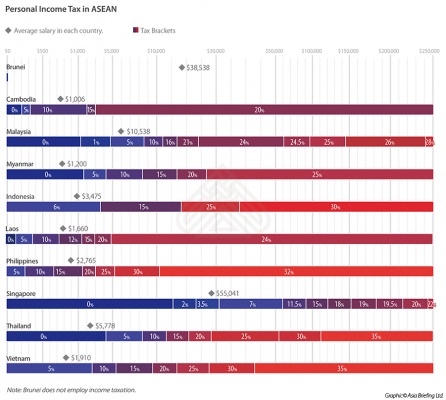

infographic

Comparison of Personal Income Tax Brackets in ASEAN

- May 2016

- Members Access

This infographic compares the different PIT taxation brackets across ASEAN member countries.

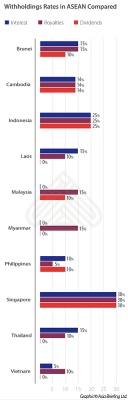

infographic

Withholdings Rates in ASEAN Compared

- May 2016

- Members Access

This infographic compares the withholdings rate for different types of funds in different ASEAN member countries.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us