Our collection of resources based on what we have learned on the ground

Resources

guide

Transfer Pricing in China 2016

- May 2016

- US $24.99

Transfer Pricing in China 2016, written by Sowmya Varadharajan in collaboration with Dezan Shira & Associates and Asia Briefing, explains how transfer pricing functions in China. It examines the various transfer pricing methods that are available to ...

magazine

Remitting Profits from Vietnam

- May 2016

- Members Access

In this issue of Vietnam Briefing, we outline existing regulations on remittance and provide guidance on how to ensure compliance in order to repatriate profits in a timely fashion. We highlight relevant government bodies, outline steps required to s...

magazine

Managing ASEAN Expansion from Singapore

- March 2016

- Members Access

For the second issue of our ASEAN Briefing Magazine, we look at the benefits of using Singapore a hub for the management of regional operations throughout ASEAN. We firstly focus on the position of Singapore relative to its competitors, such as the N...

infographic

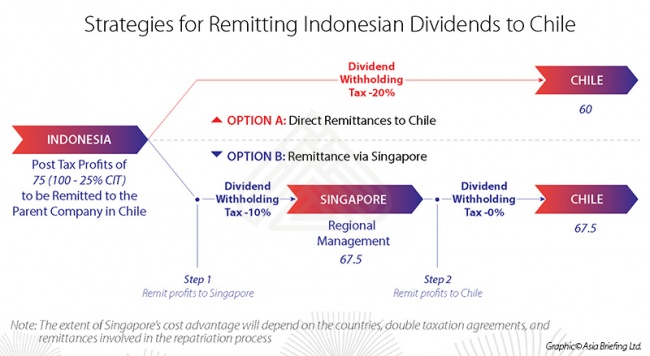

Strategies for Remitting Indonesian Dividends to Chile

- March 2016

- Members Access

This infographic illustrates how to remit dividends received in Indonesia through two different paths to Chile.

Q&A

What advantages does Singapore have over taxation?

- March 2016

- Members Access

To encourage investments, Singapore imposes a relatively light tax burden on those invested within its borders. Corporate income tax (CIT) stands at 17 percent while dividends can be repatriated without imposed withholdings. However, the true competi...

Q&A

What compliance tasks should companies in Singapore complete in order to qualify...

- March 2016

- Free Access

Obtaining a Certificate of Residence (COR), issued by the Internal Revenue Authority of Singapore (IRAS) and ensuring Permanent Establishment (PE) status within respective ASEAN states are the two most important compliance tasks that must be complete...

Q&A

What is a Certificate of Residence (COR) in Singapore?

- March 2016

- Free Access

Singapore’s COR is an indicator to tax authorities – in Singapore and abroad – that a given company has established operations within the state of Singapore. Within Singapore, a COR is used to establish a company’s eligibility...

Q&A

How can firms in Singapore offset their international taxation?

- March 2016

- Members Access

Currently those incorporated within Singapore and holding a Certificate of Residence (COR) will be able to choose between two methods, the credit method and the exemption method, in order to offset their international taxation. Under the credit metho...

Q&A

What is the benefit of routing investments through Singapore?

- March 2016

- Free Access

Companies operating in ASEAN might find that the cost of transferring profits back to their home country has increased in the absence of up to date DTAs. By contrast, with many DTAs in place and 0 percent withholdings tax of its own on dividends, Sin...

Q&A

What is the history of China's tax policy?

- February 2016

- Members Access

In 1950, The Implementation Standards of National Tax Policies was first put into effect by the State Council (known at the time as The Government Administration Council) to lay a legal framework for nationwide taxation in China. In 1978, Deng ...

Q&A

What organization is the highest tax authority in China?

- February 2016

- Free Access

China’s highest tax authority is The State Administration of Taxation (SAT), who sits directly below the State Council. Given its position, the SAT handles a multitude of tasks. It oversees the country’s tax system, drafts nat...

Q&A

What methods do China’s State Administration of Taxation and Ministry of Finan...

- February 2016

- Members Access

China’s consumption tax can be applied to a wide range of products ranging from high energy products like cars, to those deemed luxury items and nonessentials. As a result, consumption tax rates vary considerably. Once the tax rate ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us