Our collection of resources based on what we have learned on the ground

Resources

infographic

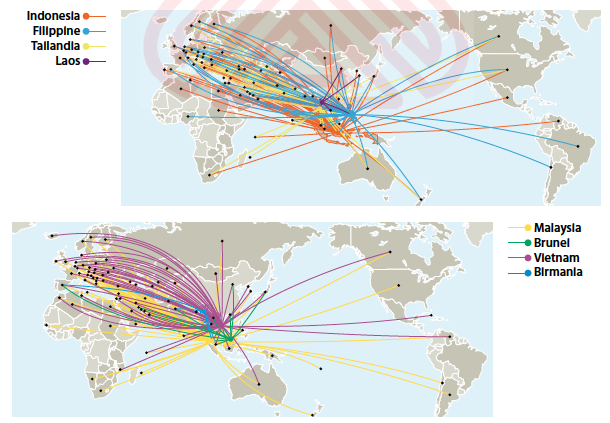

DTA in Asia: Indonesia, Filippine, Thailandia, Laos, Malesia, Brunei, Vietnam, B...

- December 2013

- Free Access

infographic

Procedure e stima dei tempi per una comune richiesta secondo il nuovo sistema de...

- December 2013

- Free Access

infographic

Che cos'� esattamente l'ASEAN?

- December 2013

- Free Access

L'ASEAN, Associazione delle Nazioni del Sud-Est Asiatico, è stata fondata nel 1967 e riunisce dieci Paesi asiatici in un unico blocco di scambio economico. Ne fanno parte Brunei, Cambogia, Indonesia, Laos, Malesia, Filippine, Birman...

infographic

Flussi commerciali all'interno dell'Asia

- December 2013

- Free Access

All'interno dell'Asia, i corridoi commerciali bilaterali che coinvolgono Cina e India registreranno la maggior crescita, rendendo l'Asia (Giappone escluso) detentrice di un terzo dell'economia globale totale entro il 2020 (raddoppi...

infographic

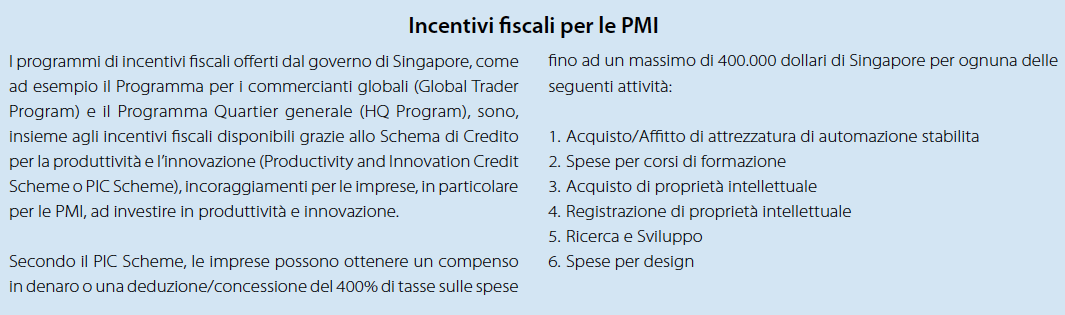

Incentivi fiscali per le PMI a Singapore

- December 2013

- Free Access

Centro finanziario e del settore terziario, Singapore è di fatto la capitale finanziaria del blocco ASEAN. La sua vicinanza agli altri paesi della macroregione, fa di Singapore la destinazione migliore per tutte le attività nella reg...

infographic

Legge societaria di Singapore, ultimi cambiamenti nel 2013

- December 2013

- Free Access

Il Ministero delle Finanze di Sinagpore nell'ottobre 2012 ha accettato ben 192 indicazioni provenienti dallo Steering Committee for the Review of the Companies Act. Questa sostanziale revisione dovrebbe portare al miglioramento del quadro ...

infographic

Il Vietnam come centro produttivo per le vendite in Cina

- December 2013

- Free Access

La politica espansionistica del Vietnam sul commercio con i Paesi limitrofi sta per dare i suoi frutti. Il Paese infatti, con l'entrata in vigore delle Convenzioni di Libero Scambio ASEAN del 2015 con Cina, India, Giappone, Corea del Sud e...

infographic

Entwicklungszonen in Asien

- December 2013

- Free Access

Die Infografik stellt kurz und knapp die einzelnen Entwicklungszonen in asiatischen Ländern dar.

Q&A

How manufacturing in Vietnam will help targeting Chinese market?

- December 2013

- Free Access

With wages being about 30 percent of those in China and fairly low land use cost, Vietnam is an attractive manufacturing destination lately. The ASEAN Free Trade Agreement that China just signed eliminates import tariffs for thousands of products tha...

Q&A

Why is Association of South-East Asian Nations (ASEAN) a strategic geographical ...

- November 2013

- Free Access

Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam together form one of the world's largest emerging markets. Annual growth in that region is 5 percent and expecting to grow at that rate till 2020. Howe...

Q&A

Why is the number of multi-national companies investing in Vietnam constantly gr...

- November 2013

- Free Access

Investment's volume in Vietnam has increased in the recent years due to its cheap labor resources, positive political, economic and demographic trends.Over the past 20 years FDI inflows into Vietnam increased tremendously, especially into manufacturi...

Q&A

How does investing in Vietnam help targeting the emerging ASEAN region?

- November 2013

- Free Access

Vietnam's export to the rest of ASEAN nations have reached US$ 13.6 billion in 2011 and accounted for about ten percent of the country's total GDP in 2012 (US$ 138.1 billion). With tariffs reduced on over 4,000 different products, average tariff rate...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us