Our collection of resources based on what we have learned on the ground

Resources

Q&A

What are the two main methods by which Singapore and its treaty partners grant r...

- February 2015

- Members Access

There are two main methods which are used including the credit method and the exemption method. The credit method means that Singapore will grant a foreign tax credit to an entity that has paid taxes on business profits derived in the source state. T...

Q&A

Who can take advantage of the benefits of the double tax agreements (DTAs) in Si...

- February 2015

- Free Access

Only Singapore residents or Singapore treaty partners can benefit from the double tax agreements in Singapore. In fact, you also have to obtain a Certificate of Residence (COR) from the Inland Revenue Authority of Singapore before you can claim benef...

infographic

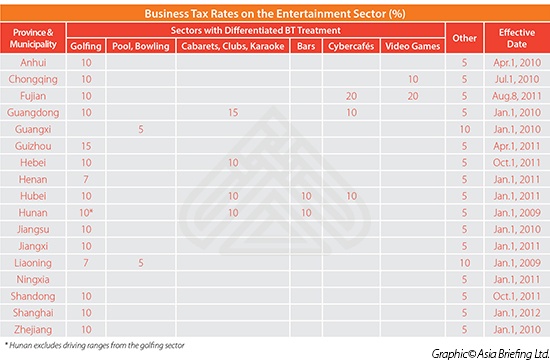

Business Tax Rates on the Entertainment Sector (%)

- February 2015

- Members Access

List of provinces and municipalities and their business tax rates on different entertainment sectors in China.

magazine

China Investment Roadmap: The Entertainment Industry

- February 2015

- Members Access

In this special edition China Briefing Industry Report, we cast our gaze over the broad landscape of Chinaâs entertainment industry, identifying where the greatest opportunities are to be found and why. Next, we detail some of the most important...

magazine

Using India's Free Trade & Double Tax Agreements

- February 2015

- Members Access

In this issue of India Briefing magazine, we take a look at the bilateral and multilateral trade agreements that India currently has in place and highlight the deals that are still in negotiation. We analyze the countryâs double tax agreements, ...

Q&A

What are Double Tax Agreements (DTAs) and how might foreign investors in India b...

- February 2015

- Free Access

Double Tax Agreements (DTAs) are bilateral agreements under which two states formalize tax rates (for taxes ranging from corporate to withholding tax) for individuals and corporate entities. India has over 90 such arrangements with other countries. F...

Q&A

Why is Singapore such an important source of Foreign Direct Investment (FDI) int...

- February 2015

- Free Access

Singapore accounted for almost 25% of India’s total Foreign Direct Investment (FDI) in 2013-14. This large share is explained by a provision of Singapore Double Tax Agreement (DTA) with India – the Limitation of Benefit (LoB). The LoB pro...

Q&A

What effect has the ASEAN- China Free Trade area had on China and ASEAN as a who...

- February 2015

- Free Access

The ASEAN–China Free Trade Area is the world’s largest free trade area in terms of population and third largest in terms of nominal GDP after the European Union and NAFTA. The original FTA reduced tariffs on nearly 8,000 product categorie...

Q&A

What are China's regulations on granting Double Taxation Avoidance?

- February 2015

- Free Access

Before it will grant DTA (Double Taxation Avoidance) relief from Withholding Tax on dividends, interest or royalties, the SAT (State Administration on Taxation) must be satisfied that the applicant company in a DTA partner jurisdiction is indeed the ...

Q&A

When is withholding tax charged in China?

- February 2015

- Free Access

Withholding Tax (WT) is charged on an array of service fees billed by a company in its home jurisdiction to a company (either a client or subsidiary) in China for services provided by the former to the latter. As corporate income tax (CIT) cannot be ...

Q&A

Why is the significance of permanent establishment in DTAs?

- February 2015

- Free Access

Permanent establishment (PE) – defined as a fixed place at which the business of an enterprise is carried out in a given country. If a non-resident enterprise (in terms of China) is a tax resident of a jurisdiction that has a DTA in place with ...

Q&A

What is the methods of applying for DTA benefits in China?

- February 2015

- Free Access

For foreign investors doing business in China, securing DTA benefits is an important measure for reducing the tax burden as stipulated by Chinese tax law and thereby maximizing profit. In addition to satisfying the specific requirements of the releva...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us