Our collection of resources based on what we have learned on the ground

Resources

infographic

Corporate Taxes in Singapore

- January 2014

- Members Access

Introduction to Corporate Taxes in Singapore, including corporate income tax, goods and services tax, and standard tax on dividends.

infographic

House Rent Allowance Exemption under Indian Laws

- January 2014

- Members Access

If a company chooses to provide House Rent Allowance(HRA) to its employees, the amount of this allowance exempt from tax is the lowest of three number.

infographic

Corporate Taxes in Vietnam

- January 2014

- Members Access

Introduction to Corporate Taxes in Vietnam, including corporate income tax, value-added tax and standard tax on dividends.

infographic

Key Taxation Deadlines in Vietnam

- January 2014

- Members Access

Key Taxation Deadlines in Vietnam, including PIT and Corporate Tax Filing deadline which is Mar 31 and Fiscal Year End which is Dec 31.

infographic

Main FDI Source Countries/Regions in Vietnam

- January 2014

- Members Access

Main FDI Source Countries/Regions in Vietnam: HongKong, Japan, Singapore, Korea, China, Taiwan.

infographic

Foreign Direct Investment (FDI) by Economic Activity in Vietnam

- January 2014

- Members Access

5 top economic activities invested by FDI in Vietnam

infographic

Individual Income Tax Rate in China

- January 2014

- Members Access

For different level of income, Individual Income Tax Rates are different in China

infographic

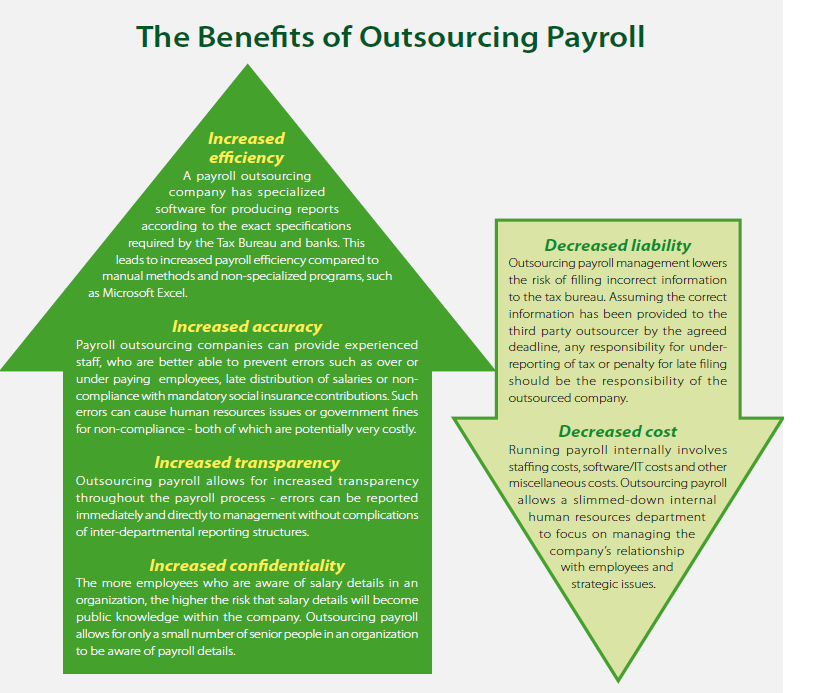

The Benefits of Outsourcing Payroll India

- January 2014

- Free Access

Six Benefits of Outsourcing Payroll in India

infographic

Individual Income Tax Rate in Hong Kong

- January 2014

- Members Access

In Hong Kong, salaries tax payable is the lower of two calculation methods.

infographic

Individual Income Tax Rate in Singapore

- January 2014

- Members Access

Singapore imposes a progressive tax ranging from 0 to 20 percent on the individual income of a tax resident.

infographic

Individual Income Tax Rate in India

- January 2014

- Members Access

India imposes different sets of progressive tax rates, ranging from 10-30 percent.

infographic

Individual Income Tax Rate in Vietnam

- January 2014

- Members Access

In Vietnam, personal income is taxed according to seven progressive rates from 5 to 35 percent.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us