Our collection of resources based on what we have learned on the ground

Resources

Q&A

What factors should businesses in China consider to estimate possible changes in...

- May 2014

- Members Access

In estimating changes in their tax burden, businesses can consider the following factors: The proportion of expense that is input VAT deductible against the income; Ability to obtain certificates for claiming input VAT; Composition of suppliers;...

infographic

Individual Income Tax Return in China

- January 2014

- Free Access

A template of an individual income tax return in China.

magazine

Der Große Steuervergleich für Asien 2014

- November 2013

- Members Access

Im Hinblick auf die geltende Steuergesetzgebung bestehen erhebliche Unterschiede zwischen den asiatischen Ländern. In dieser Ausgabe wollen wir Ihnen einen aktuellen Ãberblick über diejenigen Steuern liefern, die für ausländische Inves...

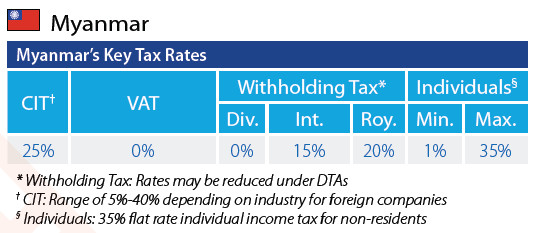

infographic

Key Tax Rates in Myanmar

- July 2013

- Free Access

The table shows the different tax rates in Myanmar.

infographic

Key Tax Rates in Cambodia

- July 2013

- Free Access

The table shows the different tax rates in Cambodia.

infographic

Key Tax Rates in the Philippines

- July 2013

- Free Access

A table showing the different tax rates in the Philippines.

infographic

Key Tax Rates in Hong Kong

- July 2013

- Free Access

The table shows the different tax rates in Hong Kong.

infographic

Key Tax Rates in Singapore

- July 2013

- Free Access

The table showes the different tax rates in Singapore.

infographic

Definitions of Permanent Establishments

- July 2013

- Free Access

The table outlines the requisites for different types of Permanent Establishment (PE).

infographic

Key Tax Rates in Laos

- July 2013

- Free Access

The table showes the different tax rates in Laos.

infographic

Key Tax Rates in Brunei

- July 2013

- Free Access

The table shows the different tax rates in Brunei.

infographic

Key Tax Rates in Malaysia

- July 2013

- Free Access

The table shows the different tax rates in Malaysia.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us