Our collection of resources based on what we have learned on the ground

Resources

infographic

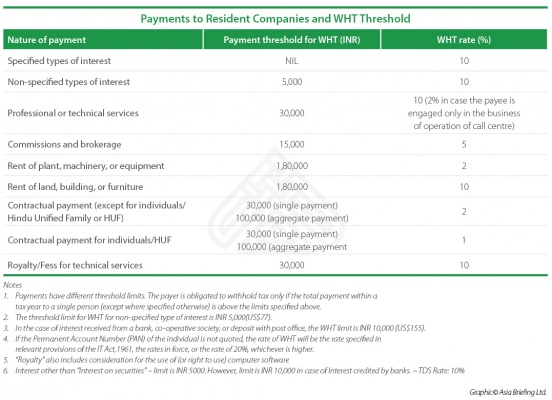

Withholding Tax (WHT) Rates on Payments to Resident Companies in India

- July 2017

- Members Access

This table shows the rates applied to parts of resident companies' income in India.

infographic

Withholding Tax (WHT) Rates on Payments to Non-resident Companies in India

- July 2017

- Members Access

This table shows the rates applied to parts of non-resident companies' income in India.

infographic

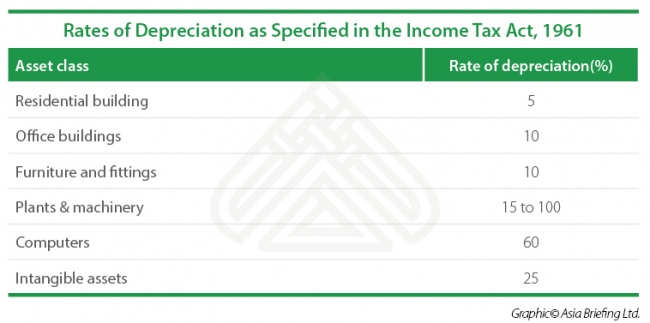

Rates of Depreciation for Companies' Fixed Assets in India

- July 2017

- Members Access

This table shows the rates of depreciation on specific assets of a company in India.

infographic

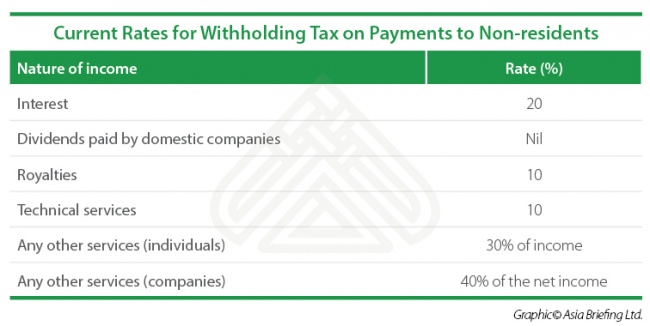

Withholding Tax (WHT) Rates on Payments to Non-residents in India

- July 2017

- Members Access

This table shows the rates applied to parts of non-residents' income in India, including royalties, technical services, etc.

magazine

Internal Control in China

- July 2017

- Members Access

While fraud is a well-known issue for foreign investors doing business in China, many companies underestimate the risks of fraud occurring from within their own organizations. The answer to limiting exposure to these risks is internal control. In thi...

partner-publication

DPRK Business Monthly: July 2017

- July 2017

- Members Access

This regular publication looks at current international, domestic, and peninsular affairs concerning North Korea while also offering commentary and tourism information on the country.

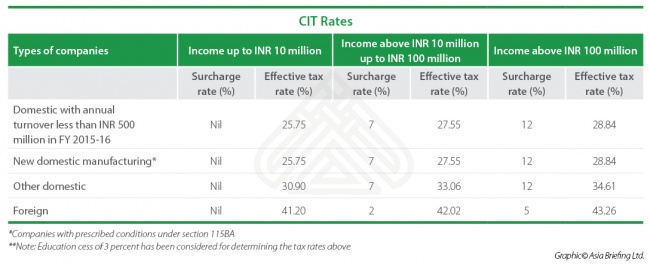

infographic

Corporate Income Tax (CIT) Rate in India

- July 2017

- Members Access

This table shows the Corporate Income Tax (CIT) rate imposed on the net income of companies registered in the country and foreign companies earning income in India.

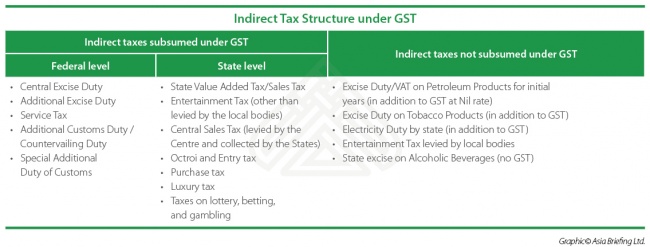

infographic

Indirect Tax Structure under Goods and Services Tax (GST) in India

- July 2017

- Members Access

This table shows the aggregation of India's new Goods and Services Tax (GST).

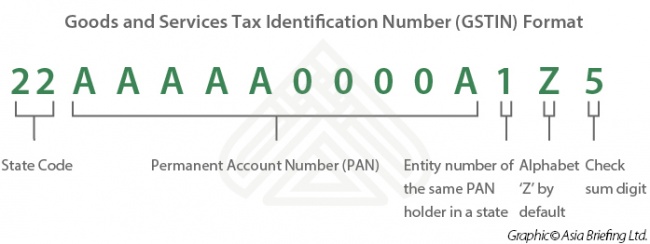

infographic

India's Goods and Services Tax Identification Number (GSTIN)

- July 2017

- Free Access

This infographic shows the elements that compose India's Goods and Services Tax Identification Number (GSTIN)

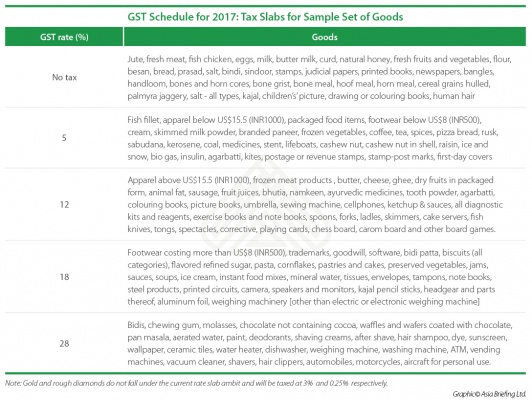

infographic

Goods and Services Tax (GST) Rates for Goods in India

- July 2017

- Members Access

This table shows the Goods and Services Tax (GST) rates applicable for different goods in India.

infographic

Goods and Services Tax (GST) Rates for Services in India

- July 2017

- Members Access

This table shows the Goods and Services Tax (GST) rates applicable for different services in India.

infographic

Export Procedure Steps in India

- July 2017

- Free Access

This infographic shows the steps required to export goods in India.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us