Our collection of resources based on what we have learned on the ground

Resources

infographic

Determining Individual Income Tax (IIT) for Expatriates based on Residence Statu...

- July 2017

- Members Access

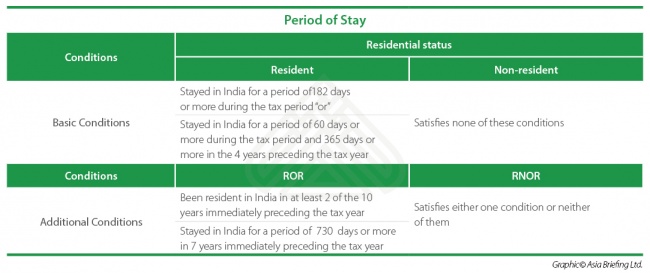

This table shows the conditions on the different residential status to determine expatriates Individual Income Tax (ITT).

presentation

The Goods and Services Tax: Behind the Biggest Tax Reform in Independent India

- July 2017

- Free Access

In this presentation, International Business Advisory Manager Sahil Aggarwal and Senior Associate Shashi Verma outline how your business can take advantage of the newly introduced GST regime.

webinar

The Goods and Services Tax: Behind the Biggest Tax Reform in Independent India

- July 2017

- Free Access

In this presentation, International Business Advisory Manager Sahil Aggarwal and Senior Associate Shashi Verma outline how your business can take advantage of the newly introduced GST regime.

infographic

Required Paid-in Capital in the Philippines

- July 2017

- Members Access

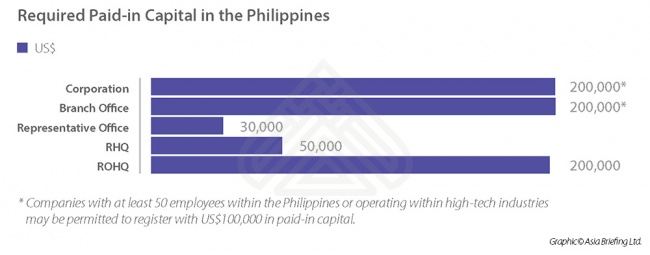

This graph shows the required paid-in capital by type of corporate scheme in the Philippines.

infographic

Permitted Activities for Regional Headquarters in the Philippines

- July 2017

- Members Access

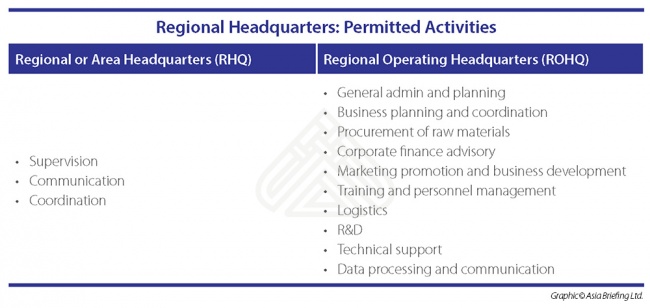

This table shows the operations legally allowed for the two types of regional headquarters in the Philippines.

infographic

Comparison of Pros and Cons Between Corporate Structures in the Philippines

- July 2017

- Members Access

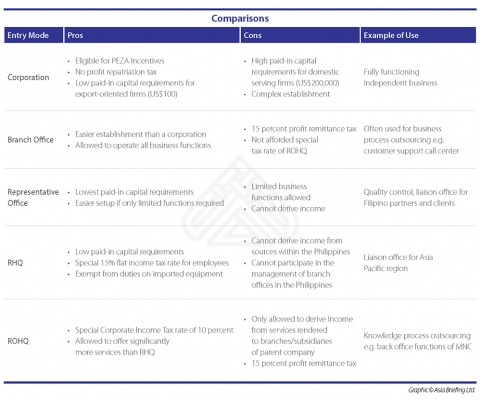

This table shows a comparison between the pros and cons of the available corporate structures in the Philippines.

magazine

Choosing an Effective Entry Model for Vietnam Investments

- July 2017

- Members Access

In this issue of Vietnam Briefing we detail the structure of Vietnam’s investment landscape and outline of the most prudent market entry models for foreign enterprises seeking to take advantage of ongoing reforms. We highlight opportunities for 100...

presentation

New Considerations when Establishing a Chinese WFOE in 2017

- July 2017

- Free Access

In this webinar, Kyle Freeman, International Business Advisory Manager at Dezan Shira’s Beijing office will discuss how best to set up a Wholly Foreign-Owned Enterprise (WFOE) in China.

magazine

How to Set Up in the Philippines

- July 2017

- Members Access

In this issue of ASEAN Briefing magazine, we provide an introduction to the Philippines as well as analyze the various market entry options available for investors interested in expanding to the island nation. We also discuss the step-by-step process...

infographic

Tax Incentives for Government-Encouraged Sectors in Vietnam

- July 2017

- Members Access

This table shows the preferential tax rates and exemptions for enterprises investing in Vietnam's government-encouraged sector-category A.

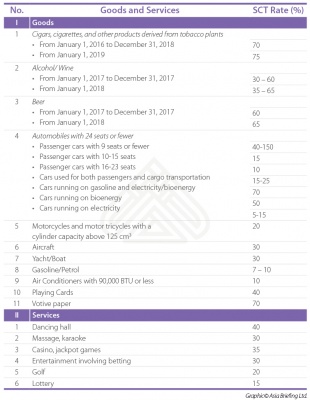

infographic

Special Consumption Tax (SCT) Tax Rates for Goods and Services in Vietnam

- July 2017

- Members Access

This table shows the Special Consumption Tax (SCT) rates for specific goods and services in Vietnam.

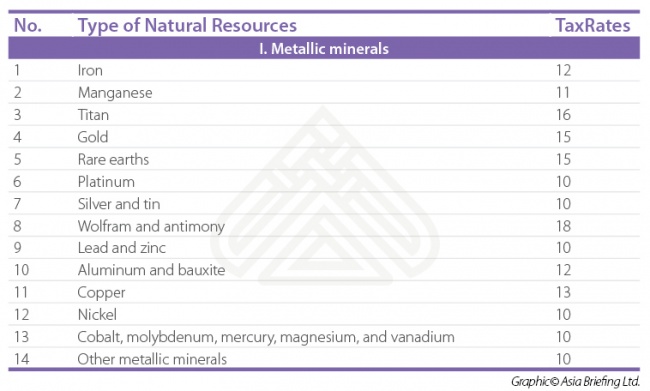

infographic

The Natural Resources Tax (NRT) Rates in Vietnam

- July 2017

- Members Access

This table shows the Natural Resources Tax (NRT) rates for different types of natural resources in Vietnam.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us