Our collection of resources based on what we have learned on the ground

Resources

magazine

Les Régions et Zones Économiques Clés du Vietnam

- October 2018

- Members Access

Les investisseurs étrangers découvriront que le succès sur le marché vietnamien est plus nuancé que les laissent penser les taux d’investissement et de croissance, et que le choix d’un emplacement adéquat à leur projet figure parmi les con...

infographic

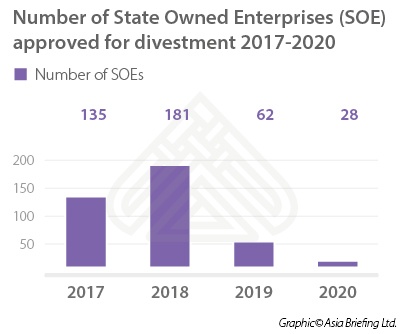

Number of State Owned Enterprises (SOE) Approved for Disinvestment 2017-2020 (Vi...

- October 2018

- Free Access

For more information on SOE disinvestment in Vietnam [button:: Visit Vietnam Briefing::http://www.vietnam-briefing.com/news/state-divestment-exciting-opportunities-investors.html/] To know about investment opportunities in Vietnam [button:: Contact ...

FTA

European Union- Vietnam Free Trade Agreement Vietnam Tariff Tables

- September 2018

- Free Access

This document is for research purposes only, not to be used or interpreted as an official document For more information [button::Contact us::https://www.dezshira.com/contact]

FTA

European Union- Vietnam Free Trade Agreement Chapter 1 to 7

- September 2018

- Free Access

EU-Vietnam Free Trade Agreement: Agreed text as of January 2016

infographic

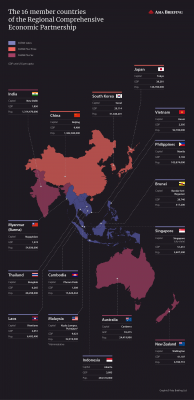

The 16 Member Countries of the Regional Comprehensive Economic Partnership

- September 2018

- Free Access

magazine

How to Manage the Labor Market in Vietnam

- August 2018

- Members Access

Vietnam's labor force is one of the major drivers of foreign investment in Vietnam. In this issue of Vietnam Briefing, we highlight the opportunities and challenges in the labor market – in areas such as productivity, wages, quality, and regional v...

magazine

Transfer Pricing in Vietnam

- April 2018

- Members Access

In this issue of Vietnam Briefing, we introduce the concept of transfer pricing and outline its importance to foreign investors operating in Vietnam. We highlight current compliance requirements, outline changes that have been made in recent months, ...

presentation

Food and Beverage in Vietnam

- January 2018

- Free Access

Presented by Rossella Bizzarri, International Business Advisory Associate in Dezan Shira's Ho Chi Minh City office, this presentation discusses the current state of foreign direct investment in Vietnam's F&B industry from a legal perspective.

magazine

Tax Incentives in Vietnam

- December 2017

- Members Access

In this issue of Vietnam Briefing, we discuss the importance of taxation to new investment projects and outline the role that corporate tax incentives can play in reducing costs in Vietnam. We highlight Vietnam’s current preferential tax rates and ...

infographic

Taxation Policy Across Asia Compared

- December 2017

- Free Access

This infographic shows a comparison between Vietnam and other Asian countries on taxation policy according to different variables.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us