Our collection of resources based on what we have learned on the ground

Resources

infographic

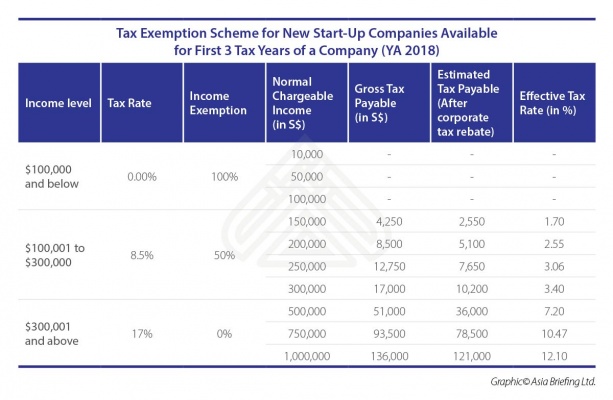

Singapore's Corporate Income Tax – Quick Facts

- August 2018

- Free Access

Singapore is globally renowned for its competitive tax structure. The country imposes a flat rate of 17 percent corporate income tax (CIT) – lowest among the ASEAN member states. The single-tier corporate tax system reduces compliance cos...

magazine

Managing Contracts and Separation in ASEAN

- July 2018

- Members Access

In this issue of ASEAN Briefing magazine, we discuss how to manage contracts and separation in five major ASEAN economies – Indonesia, Malaysia, the Philippines, Singapore and Thailand. We begin by describing the salient features of labor contracts...

magazine

The 2018/19 ASEAN Tax Comparator

- March 2018

- Members Access

In this issue of ASEAN Briefing magazine, we discuss both the continuity and change in ASEAN’s tax landscape and what it means for foreign investors. We begin by highlighting the salient features of the taxation regimes of the individual member sta...

infographic

Singapore-India FDI Flows 2014-2016

- December 2017

- Free Access

This infographic shows the foreign direct investment flows between India and Singapore.

magazine

ASEAN's FTAs and Opportunities for Foreign Businesses

- November 2017

- Members Access

In this issue of ASEAN Briefing magazine, we provide an introduction to some of ASEAN’s FTAs and how foreign investors and exporters can maximize opportunities in this dynamic region. We begin by discussing the salient features of each FTA and the ...

magazine

Les Ressources Humaines en ASEAN

- October 2017

- Members Access

Dans ce numéro d’ASEAN Briefing, nous discutons de la structure des marchés du travail en ASEAN et mettons en lumière les points les plus importants concernant les salaires et la conformité à tous les niveaux de la chaîne de valeur. Nous donn...

webinar

Salari, imposte sul reddito personale e previdenza sociale a Singapore

- August 2017

- Free Access

Erasmo Indolino, Associato del team di International Business Advisory presso Dezan Shira & Associates, introduce gli elementi essenziali per una corretta gestione dei libri paga a Singapore.

Q&A

Are there any special considerations for foreign employees’ salary in Singapor...

- June 2017

- Members Access

According to Singapore’s Employment Act applicable to both local and foreign employees, there is no statutory requirement on minimum salary to which employers are bound to. Nevertheless, when hiring a foreign national, employers must consider t...

Q&A

How is Singapore's Individual Income Tax (IIT) determined?

- June 2017

- Members Access

Progressive in nature, the Individual Income Tax (IIT) is determined by a percentage ranging from zero to 22 percent on each individual specific earnings. For example, lower than or equal to S$20,000 (US$14,200) corresponds to a zero percent income t...

Q&A

How is income tax liability determined in Singapore?

- June 2017

- Members Access

To determine income tax liability one must refer to the taxpayer’s residency status. An individual is a tax resident in Singapore if they are: a) a Singaporean; b) a Singapore Permanent Resident who resides in Singapore; c) a foreigner who has ...

Q&A

How is the income tax rate determined for non-residents in Singapore?

- June 2017

- Members Access

If an individual is physically present in Singapore for 61-182 days, his or her employment income is taxed at the flat rate of 15 percent or the progressive resident rate, whichever is higher. Director fees and other income are taxed at 22 percent. P...

Q&A

Do foreign nationals working in Singapore have to contribute to Singapore's soci...

- June 2017

- Members Access

Employers are exempted from making Central Provident Fund (CPF) contributions for foreign employees on an employment/professional visit pass or work permit. CPF is Singapore’s comprehensive social security scheme that addresses home-ownership, ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us