Our collection of resources based on what we have learned on the ground

Resources

infographic

Investing in Indonesia 2020

- September 2020

- Free Access

This collection of infographics aims to provide potential investors with an overview of Indonesia's economy, FDI, demographic, main industries, processes for setting up a business, among other pertinent information and data.

Q&A

Opportunities for Foreign Investors in India’s Healthcare Industry

- September 2020

- Free Access

To make India self-reliant and to reduce dependence on China for raw materials such as drug intermediates, APIs, key starting materials (KSMs), and medical devices, the government has announced Production-linked incentive (PLI) scheme for bulk drugs ...

infographic

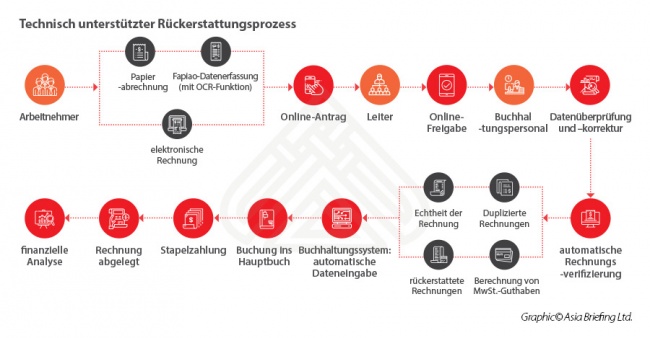

Optimieren Sie Ihre Buchhaltung und Personalsachbearbeitung in China mit Cloud-T...

- September 2020

- Free Access

Die meisten Unternehmen mit Erfahrung in China sind an die komplexen, papierintensiven und mühsamen manuellen Verfahren gewöhnt, die für die Ausführung von Back-Office-Aufgaben wie Buchhaltung, Personalwesen (HR) und Gehaltsabrechnung erforderlic...

webinar

Market Opportunities and Entry Strategies in Southeast Asia

- September 2020

- Free Access

On September 9, we joined forces with Acclime, MPG, EnterPH, Sleek and Greenhouse Co. to deliver a webinar discussing "Market Opportunities and Entry Strategies in Southeast Asia." About this event Located at the heart of the Asia-Pacific...

webinar

Hong Kong’s National Security Law and its Impact on Businesses

- September 2020

- Free Access

Under the new National Security Law, many businesses may have to adapt in some way. But adapt how, remains to be seen. Wording in the new law is deliberatly expansive, and ambiguous. On top of that, punitive actions from the United States also me...

presentation

Manufacturing Shift from China: Will Vietnam be the Best Destination?

- September 2020

- Free Access

Overview of the tariff war, COVID-19 pandemic, relocation of global supply chains, and Vietnam’s new international trade commitments. Is the newly signed EVFTA, a large workforce, and improved infrastructure in Viet Nam, good enough to attract MNC ...

podcast

China Regulatory Watch - IP Protection

- September 2020

- Free Access

Intellectual Property (IP) protection is something every company must look at when entering and operating in China, no matter which stage of investment it is in. At the request of both international and domestic players, China has been strengthening...

webinar

Pharmaceuticals in EVFTA: How Foreign Investors Can Qualify For the Preferential...

- September 2020

- Free Access

To help investors uncover their advantages, capture opportunities, mitigate challenges, and better understand the steps to access Vietnamese market through the EVFTA, Dezan Shira & Associates held the second episode of our EVFTA series, shedding ligh...

partner-publication

DPRK Business Monthly: July 2020

- August 2020

- Members Access

This regular publication looks at current international, domestic, and peninsular affairs concerning North Korea while also offering commentary and tourism information on the country.

magazine

Optimizing Your China Accounting and HR Processing with Cloud Technology

- August 2020

- Members Access

Most businesses with experience in China are accustomed to the complex, paper-intensive, and laborious manual procedures required to execute back office functions like accounting, human resources (HR), and payroll. New technology solutions are changi...

news-alert

Vietnam’s Entry Procedures for Foreign Employees amid the Pandemic

- August 2020

- Free Access

While an entry ban on most foreigners to Vietnam remains in effect, the Government has greenlighted the entry of select foreign investors, experts, and highly skilled workers. Since the decision, experts, managers and workers from South Korea, Japan,...

Q&A

Opportunities for Foreign Investors in India’s Media & Entertainment Industry

- August 2020

- Free Access

This Q&A seesion discusses the opportunities for investment in India's media and entertainment industry.India is the fifth largest M&Emarket in the world. More than 1800 films are produced every year in various languages in India. The country has a l...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us